We can confidently say that instant loan apps are those that give you a loan of $50 right away, without too many checks and forms to fill out. They help you out in an emergency, like if you get lost and need money as soon as possible.

Content Recap:

We can say that these apps were a big help when you needed them. Well, some of these apps charge interest, but not as much as apps from loan sharks that charge a lot of interest in a short amount of time. If you find these kinds of apps, don’t give them money or get money from them. They might be operating illegally, and they might sell your information to a third party.

So, in this post, we’ll show you the best app for getting an instant loan of at least $50 or less, like $25, in just a few minutes. You have 30 days to pay back these instant loans, and the interest rate is not too high.

$50 Loan Instant Apps for Instant Money

1. Chime

Chime is a fintech banking app that lets people open spending accounts that require a certain minimum balance. Not only that, but they also give their users instant loans from $20 to $200. This means you can get a loan of $25, $40, $50, $100, or even $200 immediately and without any trouble.

When you sign up for a Chime account, you can put in $200 right away without having your credit checked. But they will still check your application in some way before approving it. Chime also gives customers a free debit card that doesn’t cost anything to use.

2. PaydaySay

PaydaySay is another app that lets you get a quick loan of up to $50. The app connects people who need money with people who have money to lend. This means that you can sign up for the app as either a borrower or a lender. You can borrow between $100 and $200. But the borrowed money needs to be paid back in full by the due date.

You must pay back the loan on time so that the lender gets their money back. But if you don’t pay back the loan, interest will be added to it. PayDaySay, unlike Chime, checks your credit before giving you money. Also, since it’s a person lending you the money, the interest is a bit high.

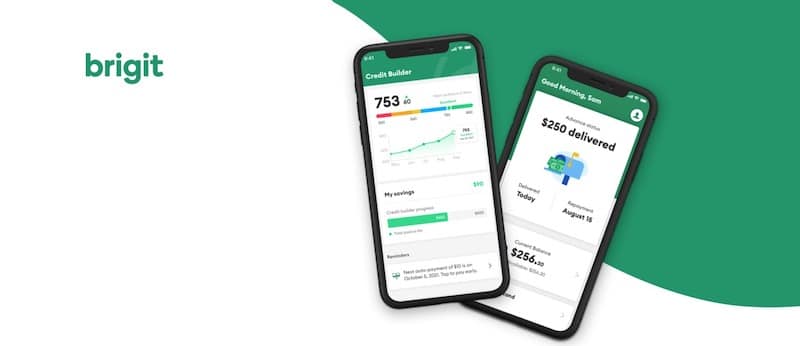

3. Brigit

Brigit is an app that lets you borrow money and connect it to your bank account. This app lets you borrow between $50 and $250. It connects to your bank account, so it can only approve your amount based on what you do with your bank. After you borrow money from Brigit, your advance repayment schedule is set up for you automatically.

The good news is that you can choose to pay back your loan early or extend the length of time you have to pay it back. This budgeting app costs $9.99 per month and does not check your credit. There is no interest and no interest is charged.

4. Earnin

Earnin is an app that can give you an instant loan of up to $100 a day and $500 a pay period. There is no fee, but the transfer rate is $2.99. The interest rate is $0, and it will take between one and three business days for your loan to arrive. You can use the more advanced features of Earnin if you link it to your bank account.

When you link Earnin to your bank account, it will automatically take back the money you borrowed when your Direct Deposit paycheck comes in. You can give Earnin a tip for the money it gave you, and you have to be working to use Earnin.

5. Dave

Dave is another instant loan app that lets registered users get up to $250 in cash right away. But the amount you get from Dave depends on many things, such as your account history, your average balance, and your loan credit score.

You can also make a direct deposit into your Dave account so that when your loan is due, you can pay it back in full. You can pay back the loan in parts or all at once, whichever you prefer. But you should set up a payment plan before the loan is due.

Dave costs $1 per month to join, and you can use your debit card and ATMs that are part of the network for free.

6. MoneyLion

MoneyLion is a banking app that can give you a $250 cash advance through a feature called “Instacash.” You can borrow anywhere from $25 to $250. To use MoneyLion, you must have an account that has been open for at least two months, show that you make regular deposits, and have a working account.

You can use your RoarMoney account or an outside checking account to pay back an Instacash loan. How much you can get will depend on how long you’ve had a MoneyLion account. The longer you have a bank account, the more likely it is that you will be able to get a higher advance loan.

Alternative To Instant Loan Apps

Why not try something else instead of looking for an app to get a $50 loan right away? If you do these things, you’ll always have $50 in your bank account if you follow these steps. You may be wondering what else you can do. Here they are, then.

Have an Emergency Fund

You must have heard people tell other people to have an emergency fund or start one. So, it’s the best piece of advice ever. In a situation like this, having an emergency fund will help you a lot. We know that this may be hard for a lot of people. But if you can save $10 per week, you’ll have up to $40 in a month, which is close to the $50 instant loan you want.

This means that in two months, you could save up to $80. You can save this money for a rainy day. You can always use them in similar situations and then get new ones. What if you don’t have a job? What should you do when you don’t have a job?

Start A Side Hustle

Start a side job while you wait for your dream job. This will help you save money and have enough cash, not just $50, but enough to help you in an emergency. We live in a modern world where all you need to work is a smartphone and an internet connection.

You can sell things online, look for work on Fiver, Upwork, and other sites, and do many other things as a side job. Here are some ideas for things you can do on the side.

- Online lesson; teach English online

- Sell items on Etsy

- Write an eBook

- Find (legit, trustworthy) gigs on Craigslist

- Sign up for TaskRabbit

- Deliver food for Instacart or DoorDash

- Drive for Uber or Lyft

- Get a job as a server for a restaurant that will let you start immediately

- Deliver pizzas

- Find gigs on Fiverr

- Babysit

- Teach Yoga

- Be a DJ

Conclusion:

A $50 instant loan app is a great way to get out of a financial burden, but you should know that it will cost you money in interest. Even if you’re not interested in some apps, you might have to pay a monthly fee to use them. Read the app’s terms and conditions before you download it, and only borrow what you can afford to pay back.