StockTown is a comic book published by the Nigerian Stock Exchange (NSE) that was first released in February 2020 to provide an easy-to-understand and humorous explanation of the complexities of the Nigerian Stock Exchange to members of the general public.

Content Recap:

The Nigerian Stock Exchange house came up with the idea for StockTown, a comic book first published in February 2020. Its purpose is to provide an easy-to-understand and humorous explanation of the complexities of the Nigerian Stock Exchange to members of the general public. The financial sector of the Nigerian economy, as with that of every other economy in the globe, has been shaken by difficult times. When it comes to making decisions, investors have to factor in a significant amount of uncertainty. In recent years, an excessive number of events have created uncertainty in the global economy.

Currently, over 37% of Nigeria’s population is still not included in the country’s financial system; hence, this requires much attention. The population that is barred from traditional forms of financial support has a high risk of becoming mired in a never-ending cycle of poverty, which, in turn, retards the growth of our overall economy.

Even though we are going through these difficult times, intelligent investors are still smiling all the way to the bank. It is often believed that only highly wealthy people put their money into stocks and shares of other publicly traded companies. Please remember that this kind of thinking belongs in the stone era; the modern world has progressed past that. Nigeria’s financial ecosystem can now support all kinds of investments, including long-term, short-term, high-volume, and low-volume investments, through the timely introduction of more innovative goods and services.

What is NSE StockTown?

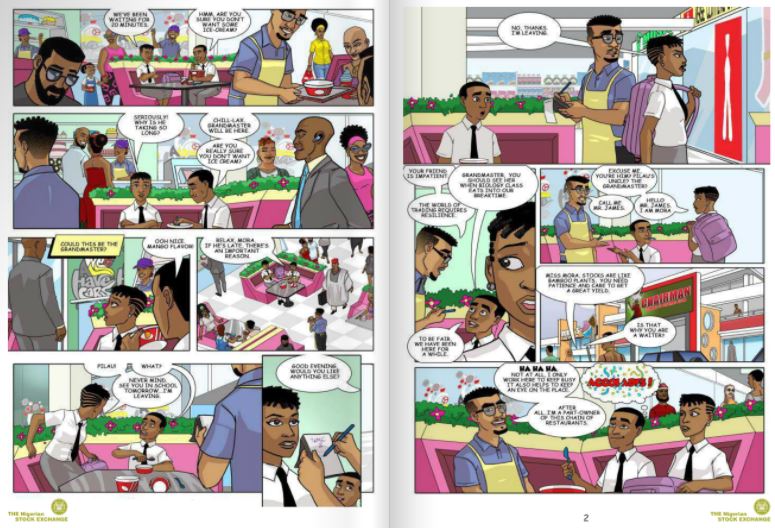

People of all ages can find something to enjoy in the NSE StockTown project thanks to the usage of humorous cartoon characters. The story’s contents and the characters’ behaviors will portray all of the emotions we feel at various stages of our economic lives.

In the first issue, readers are introduced to young Mora Johnson and her family, who are middle-class members. They are going through a difficult financial time, which is what motivated Mora to desire to gain more knowledge about investing and becoming financially independent. The story’s plot has been written to address concerns regarding personal finances that are shared by a sizeable portion of the general population. At the same time, the story aims to simplify investment terminology and the process of making investments, as well as to highlight the various investment products that are suitable for investors with varying investment goals, risk tolerances, and income levels.

During the presentation of the comic book, Oscar N. Onyema, OON, Chief Executive Officer of the NSE, stated that “StockTown is a product of a passionate idea long held by the Exchange to empower individuals across all levels to make good financial decisions and improve their lives now and in the future. “StockTown” is a product of a passionate idea long held by the Exchange to empower individuals across all levels to make good financial decisions and improve The Exchange is always looking for new ways to explain the concepts of saving money and investing by utilizing the various products that are available through its platform, even though the financial landscape is constantly shifting and evolving. We have high hopes that our comic, which explains the concept of buying and selling stocks in easy-to-understand language, will attract people who are currently excluded from the financial system, millennials, and fans of comics in general.

Myths About Investing and Financial Literacy

It is Exclusive to the Rich and Wealthy

As mentioned earlier, the average person believes that the only people who can invest in the stock market or the NSE market are wealthy. Please dispute this allegation once more. It is a way of thinking that has put many common people on a path that inevitably leads to a tragic downward spiral of poverty and debt.

It is Too Complex

The uninitiated person believes that participating in the stock market and making financial investments are far too complicated for the average person to comprehend. The importance of accessing the appropriate and accurate information at the appropriate moment cannot be overstated. In recent years, those in charge of regulating the nation’s numerous financial markets and the major players in those markets have made significant efforts to dispel this notion. Therefore, ensuring that a more significant number of people have a fundamental understanding of trading in the stock market.

It is Risky

The uninitiated person believes there is simply too much of a chance of losing money when one invests their resources in the financial markets. This is not the case. Every possible opportunity comes with a fair share of the inherent danger in this industry.

Why is StockTown Necessary?

The Exchange has a deep commitment to increasing the level of financial awareness in Nigeria, and the launch of StockTown expands on that commitment.

To correct misconceptions…

All of the aforementioned misunderstandings regarding investing and the NSE are held by the typical Nigerian citizen who is not financially savvy. They believe investing in the NSE, and other stocks are too expensive, too dangerous, and only for people with exceptional intelligence. Everyone should have at least a basic understanding of how to handle their money to keep track of their income and outgoings. It is high time that the narrative around novice investors was revised and that more conscious investors began entering the stock market.

To help our young…

The younger generation, who are also targets of this innovation, must begin studying the dos and don’ts of investments and basic financial literacy skills as soon as possible. The earlier in life they learn about personal finance, the fewer financial blunders they are likely to make later in life.

The Exchange undertakes many projects geared at children and young people on an annual basis to foster the development of a generation that is knowledgeable about personal finance.