Content Recap:

The main goal of the group is to offer a way to invest that gives returns with little risk. The National Bonds in the UAE are important because they are meant to help the average person get rich.

Eligibility:

UAE Nationals (called “Emiratis”), resident expatriates, and even people who live abroad can take part in national bond programs.

You have to be at least 21 years old to buy a national bond.

Parents or legal guardians are the only ones who can buy savings bonds for children under 18.

There are no rules about how much money you need to have to be able to buy bonds. Anyone with any amount of money can invest in National bonds.

Profit Rates of National Bonds UAE:

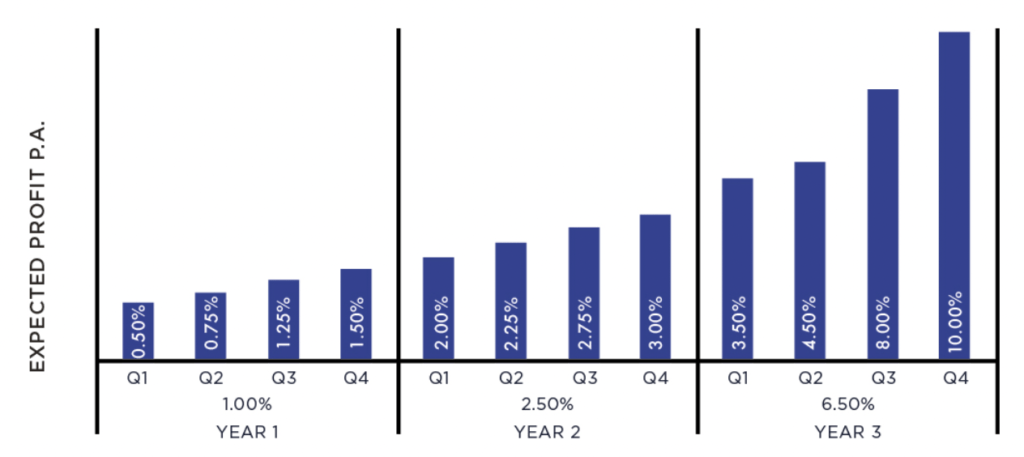

National Bonds pay more for longer terms. So, the longer you save, the more money you get back.

Since 2014, the profit rates have gone up every year, and the more good news is expected.

- 2014: Profit rates on the regular saving bonds were 1.2%

- 2015: Profit rates on the bonds above AED 50,000 were around 1.76%

- 2016: Profit rates were almost the same of 2015 which is around 1.76%

- 2017: Returns significantly increased to 2.82% on the regular saving bonds

- 2019: Profit rates on the regular saving bonds were around 2.09%

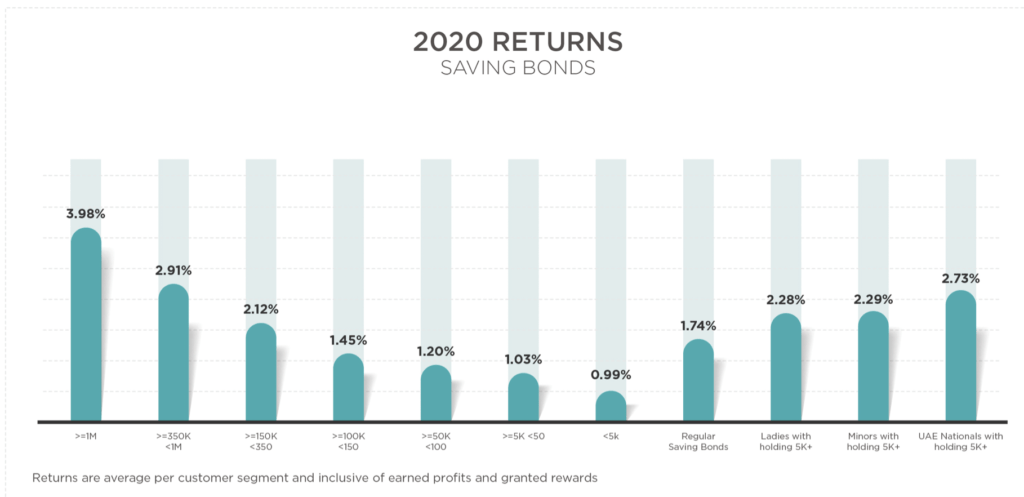

- 2020: The below Chart shows the average returns on Saving Bonds based on the value invested in 2020.

For Saving Bonds:

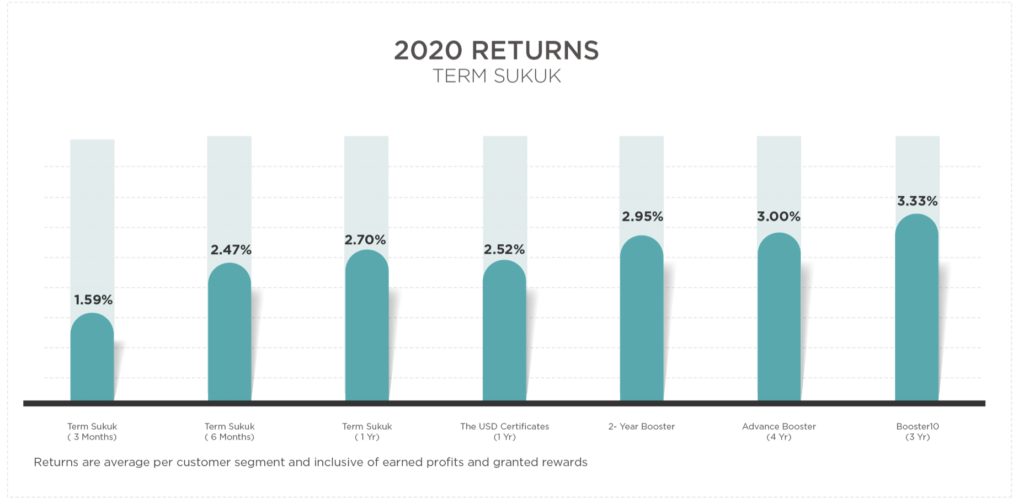

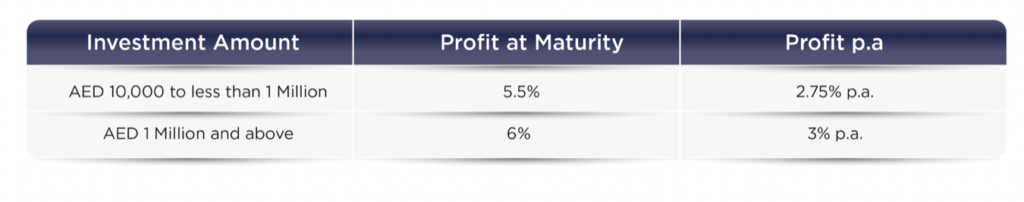

For Term Sukuk:

Profit rates are going up because money is being put into different projects. In general, the profit rates are higher than bank interest rates, and the profits are meant to help your savings grow.

Popular Products of National Bonds of UAE:

National Bonds of UAE has a wide range of financial products for you. All of the products are made to help you keep your money safe and make money from it. These are some of the products:

Savings Bonds

The savings bond is a cheap way to save as much or as little as you want. You can buy savings certificates that cost as little as AED 10. By saving money with this product, you can make money every year. You can also join the National Bonds Reward Programs if you qualify. You can easily get this product if you are a citizen of the UAE and are at least 21 years old.

Booster 10

Booster 10

Starting with AED 10,000, you can invest in this plan. Profits are paid out every three months, returns are high, and people who buy this product can enter 8 Millionaire draws and 16 luxury car draws every year.

In the chart below, you can see how Booster 10 works.

Payout

Payout

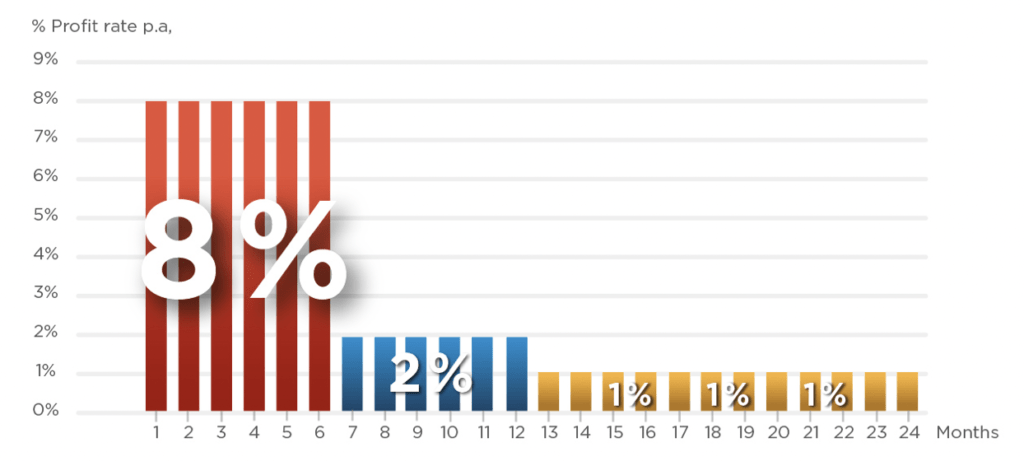

The payout product involves putting money into a plan that lasts two years and pays up to 8% in the first six months. You can get your profit every month and can cash it out whenever you want. Also, the Payout product protects your capital and is a low-risk product because of this.

The table below shows how Payout works.

2 Year Booster

The 2 Year Booster is a product that gives you money back after 2 years. The return is calculated to be 6%, which is paid when the loan is paid off. You need at least AED 10,000 to invest, and you can get your money back at any time.

Advance Booster 12%

National Bonds has a product that gives you advance returns of 3% per year so that you can get your money back early. The plan is for four years, but the money comes in before the four years are up. You can also get the payments back early if you need money.

Education Plan

Planning is impossible if you don’t know how much money you’ll have for your child. Well, this is what the Education Plan is for. By using the plan to save, you can make profits that add to your funds.

You need to know how long the plan will last before you can decide how much to put into it. If you want to save for a long time, the monthly payment is low, but the annuity is higher if you save for a short time. The product is low-risk and aims to keep your money safe. As you invest your savings for the future, you don’t have to worry about your child’s money.

Cost of National Bonds of UAE:

You can invest as much as you want in National Bonds, but the least you can do is 100 AED, which gets you 10 bonds at AED 10 each or just one bond.

Reward Program of National Bonds of UAE:

The Reward Program is one thing that makes National Bonds stand out.

Most of the time, the Reward Program has between two and four lucky draws per year. If you put money into something, you can make a claim on it. The gift is between 50 AED and 1,000,000 AED. If you’ve put a lot of money away for a long time, you might be one of the lucky investors.

The most recent reward program, which ended in 2020, had great deals. Over 64,000 people who owned bonds won prizes. Twelve Tesla cars, AED 35 million, and four Nissan Patrols were among the interesting offers.

Benefits of Investing in National Bonds of UAE:

Low-risk Investment: National Bonds are a low-risk investment because they are government security. You are sure to get paid, and the risk of not getting paid is low. The goal of the government program is to get people to save money and give them a return on their savings.

Average returns: Compared to most UAE savings accounts, National Bonds give you better returns on your money. The Advance Boost 12 percent gives you a return of 12% over a 4-year period, which can help your money grow even more.

Sharia Compliant: Sharia rules are followed by the National Bonds of UAE. You can be sure that your investment is a safe way to borrow money and helps people be socially responsible.

Investment Initiatives of National Bonds of UAE:

National Bonds has put money into some projects in order to make more money. AED 1.6 billion is being spent on the Skycourt real estate projects in the UAE. The project will improve Dubai’s social and economic situation and make money at the same time.

The unique Soul Extra is another thing that National Bonds does. The goal of the development is to make money while giving space to both government and local businesses.

The main parts of the asset allocation for National Bonds are deposits, fixed income, real estate for yields, and stocks and bonds. Most of the money it spends is on local businesses.

Anti Money Laundering Framework:

A lot of rules are followed by National Bonds. One of these is the framework they use to guide their investments to stop money laundering.

National Bonds uses “Know Your Customer” to find out who their customers are, flags suspicious activities, and looks at the risk factors of both the product and the investor. Overall, you can be sure that your money will not be used for activities that involve laundering money.

Value of Investment / Risk Reward:

National Bonds are a great way to put your money away. If you invest in its product, you can get a better return on your savings than at a bank. In fact, National Bonds of UAE is still at the top of many organizations and will give you a run for your money.

Bond holders also like saving money with a Sharia-compliant scheme. Most of the products that National Bonds sells are made to fit the different needs of its investors. The Education Plan is a great choice if you want to make a long-term investment. If you want a good return on your savings for two years, you can use the 2-year boost.

FAQs:

How can I buy National bonds of UAE?

There are different ways to buy National Bonds of UAE:

- Visit www.nationalbonds.ae, and buy online

- Call the sales team through 60052279.

- Through exchange houses such as Al Ansari Exchange

- Through National banks in UAE

Are UAE National Bonds Good Investment?

Yes, especially if you want to invest in safe things and don’t want to take chances. National Bonds are a great way to put your money away. If you invest in its product, you can get a better return on your savings than at a bank. In fact, the National Bonds of UAE is still at the top of many organizations and will give you a run for your money.

Bond holders also like saving money with a Sharia-compliant scheme. Most of the products that National Bonds sells are made to fit the different needs of its investors. The Education Plan is a great choice if you want to make a long-term investment. If you want a good return on your savings for two years, you can use the 2-year boost.

Who Can Apply for National Bonds of UAE?

The organization sells the following bonds to the public:

- A person over the age of 21 years

- Resident Expatriates

- A trustee on behalf of a minor

There is no minimum income requirement for National Bonds of UAE. Instead, you can put away any amount and make money from it.

How do I redeem my UAE National Bonds?

It’s easy to get your money back from your National Bonds. You go to www.nationalbonds.ae and sign in to your account. Click on “immediate redemption.” To get in, use your phone number and password. After that, choose how much you want to get back.

You can also go to a UAE exchange to exchange your National Bonds at any of the branches. Also, you can cash in your savings account at AI Ansari Exchange. If you only want to redeem some of your points, NBC will give you a certificate for the rest.

If you paid cash for your savings certificate, you have to wait at least 30 days before you can cash it in. But if you used credit to pay for it, you should wait 90 days before redeeming.

What is National Bonds Contact Number?

International Contact: +97148348000

UAE: 600522279

Ask for Help:

You can always talk to a Financial Advisor about your finances and explain your situation so they can help you reach your financial goal. Most of the time, Financial Advisors have access to products that you don’t, and they can recommend some great options that fit your needs.