When it comes to insurance, many people feel like they are pouring water in the sand because they are investing in something that is intangible. The most important goal of having insurance is being safe in case an unexpected loss happens. So, you basically choose to pay a small fee at present and be financially safe in the future in case of a larger and uncertain loss that may happen to you. Uncertain and unexpected situations are a part of our lives, and we should be aware of that fact and protect ourselves accordingly.

Content Recap:

For instance, if you own a house and you don’t insure it, everything that might happen to it in terms of damage will have to be paid for/reconstructed by you personally. In cases of fire, flood, or other random situations like a tree falling on your house- the expenses will have to be paid by you. That is why many people choose to pay the small fees and insure their properties so in cases like these, they will be backed up. That’s where insurance companies come in.

Many people are not a big fan of them, especially since the process for getting insurance can be long and complicated. Usually, the process of getting insurance can be exhaustive, and then when something happens filing a claim can be another complicated process where companies seek to keep their costs as low as they can. And then, even if there are no claims from your side, no benefits will be available to you because the companies pocket the money.

In recent times, Lemonade Insurance is a company that is getting a lot of fame because it is offering affordable, easily manageable insurance for renters and homeowners. The way that they tackle these problems is through peer-to-peer insurance techniques.

What is peer-to-peer insurance?

Peer-to-peer insurance is a system where a group of people pools their insurance premiums into a collective pot. When somebody from that group makes a claim, they take money out of the collective pot. For this to work smoothly, peers are grouped into separate groups where they pool their premiums for covering each other’s claims. What Lemonade Insurance provides is on this principle.

How does Lemonade Insurance work?

As I previously explained, Lemonade Insurance uses a peer-to-peer insurance system with collective pools. Once somebody from the pool needs to make a claim, the money is taken from the collective pot. That is how the people that are insured, will cover their losses during suffered damages. From their side, Lemonade takes a flat fee off every premium that they use for technology updates, paying salaries, and business costs.

In cases where the value of the collective pot is not enough to cover all the claims, reinsurance is used. The claims and costs that may happen in the upcoming year are impossible to predict beforehand. With that being said, the policyholders might pay more money than there are claims.

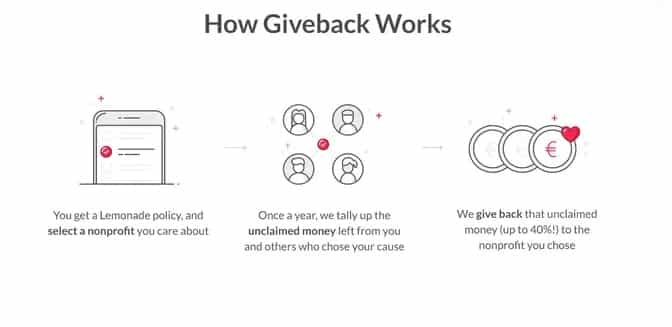

Traditional insurance companies in those cases keep the money as profits, but Lemonade, in that case, donates the extra money to charities that support the causes of your choosing. They do this through their Giveback program through which they want to “transform a necessary evil into a social good.” When you choose your policy, you will also choose a nonprofit that you are passionate about.

Once a year, Lemonade tallies up the unclaimed money and gives back up to 40% of that money to the charity that you chose. In 2019, Lemonade gave back more than 550.000 euros which is a significant social impact.

How to get Lemonade Insurance?

Lemonade Insurance is a company that is very technologically advanced. This means that they have their own AI bot which will help you with buying a policy in a matter of seconds. There is no need for filing paperwork or making phone calls to the company.

In case you need to file a claim, the process is also very easy. You open the app, answer the questions, wait for the claim to get processed, and if it’s straightforward, get paid immediately. The Lemonade experience is not only available through their website but also through iOS and Android apps. And if you are wondering what can you get insurance for:

- Fire damage

- Smoke Explosion

- Burglary Robbery

- Vandalism

- Windstorms

- Hail

- Water damage from burst pipes/leaking appliances

- Natural disasters like floods and earthquakes

- Living expenses in times of natural disasters

- Personal liability coverage

The things you will be insured for depend on what type of policy you will choose. Lemonade is not available in all the states as of now. It is only available in the following states:

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- District of Columbia

- Georgia

- Illinois

- Indiana

- Iowa

- Maryland

- Massachusetts

- Michigan

- Missouri

- Nevada

- New Jersey

- New Mexico

- New York

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- Tennessee

- Texas

- Virginia

- Wisconsin

Lemonade Pricing Policies

According to the Lemonade Blog, the average cost of a renter’s insurance policy is just $15.50 per month.

But this is the average value. Keep in mind that there are different insurance policies and the prices also vary depending on the location, the condition of the place you live in, deductibles, and what type of coverage you want to have.

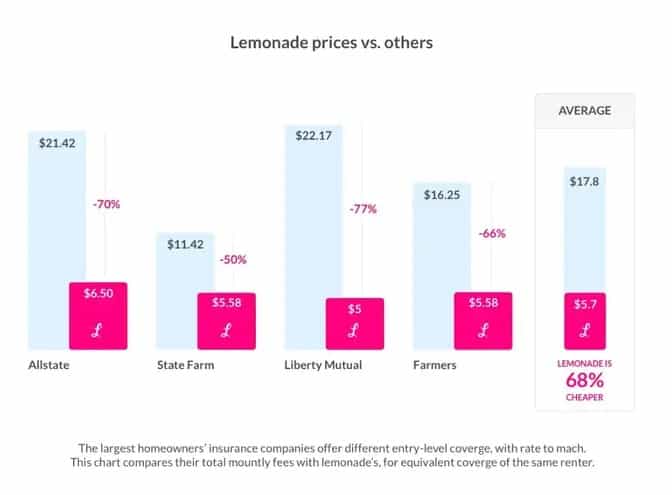

The most important thing is that Lemonade is charging up to 80% less than the largest insurers.

On the graph above you can see the prices of Lemonade Insurance compared to other large insurance companies on a monthly level.

Advantages and Disadvantages

As with literally everything in life, Lemonade Insurance has its own advantages and disadvantages.

Different people may like or dislike different things about the way Lemonade operates and what it offers or doesn’t offer.

When it comes to advantages, Lemonade offers more or less the following:

- It is affordable insurance for homeowners and renters, that can cost as low as $5 per month

- It offers free family coverage, which means that if you are insured, your family members are also insured with no additional costs

- It has transparent policies that are easily understandable and straight-forward for anybody

- It has an extremely easy process of applying for a policy

- It has also a very easy process for requiring claims that happens online

- It is basically instant coverage because it takes just a few minutes to start with, and it doesn’t require filing paperwork

- It allows people to be charitable through their Giveback program which makes a positive social impact on societies

On the other side of the spectrum, Lemonade has some disadvantages as well:

- It is not a good option for homeowners and renters that have very complex insurance needs

- It is not good for people that require in-person service from agents

- It is not good for people that want to bundle both auto and home insurance

Lemonade is not available in all the states, it is available in more than 20 states only

Conclusion

To sum up, peer-to-peer insurance is a very refreshing system that works very well.

It is a great option for those of us who don’t want to be bothered by filling out mountains of paperwork and then being obligated to pay high amounts of premiums each month.

Another very good thing is the Giveback program. The leftovers from the collective pot will be used in charitable ways of your choosing that make a social impact on our societies.

Additionally, the easy and fast application for policies that can be done on their website or apps is the best part in my opinion.

We live in a time of digital progress and signing up for important things such as insurance online is the future.

The technologically advanced AI bot usage is another plus in this direction.

It is not a surprise why Lemonade is getting very popular among people. The affordability and ease with which you will be insured are refreshing.

In times of a sudden loss, the fast and easy process of applying for claims and the fast average time of being paid on those claims can help out very much.

The wide range of coverage and the family member coverage are some of the best advantages of Lemonade insurance.