If you require additional funding, you should carefully analyze each lending option before committing. Due to the prevalence of predatory lending, it is your responsibility to be aware of your rights and take all reasonable precautions to safeguard yourself from exorbitant fees and abusive credit.

Content Recap:

Usually, predatory lenders will use aggressive techniques to get you to agree to their terms and get you to apply for loans you can’t afford. Here are some details about predatory lending and techniques to prevent it.

Predatory Lending: What Is It?

This phrase describes misleading, harsh, or unreasonable loan conditions for customers. Predatory lending means that these financing terms may include exorbitant fees and hidden costs.

A person with good credit could also be given a loan with a lower credit rating, have their equity taken away, or have their request granted with high finance charges. This financing type only benefits the crediting corporation because of all these characteristics.

These lenders typically employ pushy sales techniques and profit from the clients’ ignorance of their rights and financial management. Predatory lenders use dishonest and deceitful tactics without providing honest facts to urge and entice borrowers to take out a loan at their business that they will probably not be able to repay.

Recommendations to Protect You from Predatory Lending

What can states do to safeguard borrowers against expensive lending options? They must:

- Set limits on the interest rates for different types of loans. In the event that creditors evade them by charging exorbitant rates, interest rate restrictions may not be sufficient.

- Pay close attention to the bills for consumer loans. They should analyze all potential interest rates and unstated costs. Calculate the interest, complete APR, other finance costs, and fees that go into the overall cost of borrowing.

- Ban loan fees or limit them.

- Adopt a tiered rate for large loans with a limit of less than 36%. If a borrower receives up to $1,000, a smaller loan might have a maximum APR of 36%, while greater sums should consider a lesser interest rate.

- Considering that they exclusively profit the crediting firm and raise the cost of credit, they prohibit the sale of add-on items and credit insurance.

- To prevent exploitative lending scenarios, make it mandatory for creditors to assess the debtor’s repayment capacity.

- Limit interest-only payments, balloon payments, and excessively extended loan terms.

Tactics of Predatory Lending

While legitimate businesses like Fit My Money and accredited crediting institutions offer fair loans, unscrupulous creditors simply care about getting more money out of you. Such creditors don’t consider if the borrower has the resources to repay the amount. Predatory lending techniques take advantage of a person’s ignorance of the guidelines and conditions. These techniques consist of:

- Balloon Payment

- Excessive Charges

- Asset-Based Lending

- Loan Flipping

- Steering

- Add-On Services And Products

Balloon Payment

A sizable payment must be made at the end of the loan term. Predatory lenders frequently reduce the monthly loan payment before requiring a balloon payment. You could be forced to spend more to refinance the loan if you weren’t ready to deal with this payment and make it.

Excessive Charges

The interest rate makes no mention of such unfair expenses. Some lenders deduct costs that are greater than 5% of the entire amount from the interest.

Asset-Based Lending

When you apply for a secured loan, the lender will provide you with money based on your own valuable asset. Your house or automobile may be at risk, but not your capacity to pay off debt. As a result, a lot of borrowers struggle with debt repayment and fall behind on payments. The lender may confiscate your asset if you don’t make the loan repayment on time.

Loan Flipping

The lending firm forces a customer to refinance repeatedly while raising the interest rate and the overall cost of borrowing. It forces the borrower into a never-ending cycle of debt.

Steering

Creditors pressure borrowers into taking out pricey loans when they could be eligible for favorable terms.

Add-On Services And Products

One can be compelled to purchase needless items like single-premium life insurance for a mortgage.

Predatory lending typically involves aggressive tactics used by specific organizations to persuade borrowers to take loans they can’t afford to repay.

As a result, consumers risk defaulting on their loans and must pay exorbitant fees and extra interest to avoid getting trapped in a never-ending debt cycle. These lenders benefit from the lack of information and knowledge.

A loan shark is one instance of this lending. It is someone who gives you a cash loan at an extremely high-interest rate and could later threaten you with violence. It’s crucial to recognize the warning signs and steer clear of predators because even businesses, banks, and mortgage brokers may be abusive.

Lending Statistics

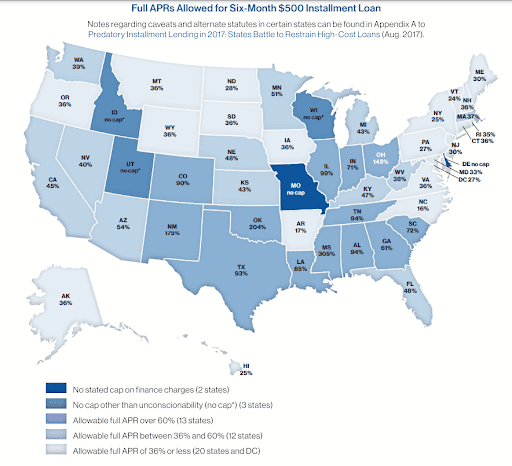

The National Consumer Law Center’s 2020 report on predatory installment lending in the USA notes that the main method by which states defend borrowers from predatory lending is limitations on interest rates and fees. These caps are risky, though.

Creditors that offer expensive loans are waging campaigns in every state to persuade decision-makers to weaken or ignore these regulations. Colorado, California, Ohio, and New Mexico improved their legislation in the last five years, lowering APR caps. On the other hand, the permitted APRs for installment loans climbed in Oklahoma and Iowa.

Conclusion

Before you sign any contracts, it’s critical to educate yourself about the different kinds of predatory loans, understand how they operate and know what to look out for. If you don’t fully comprehend the terms of debt repayment, don’t sign any documents. In order to prevent predatory lending and choose safe and legal options to meet your current financial needs, it is important to understand financial legislation and lending guidelines.