Have you heard of quick loan apps for your phone? Do you want to know about some of the best quick loan apps in Nigeria that you can use when you have to pay some bills quickly? Some of the best services are listed here.

Content Recap:

It has always been stressful to get a loan. You have to be a cooperative group member or have a bank account if you want a loan from a bank.

And that’s not the end of it. When we use the traditional methods we’re used to, getting loans for personal needs and small businesses is hard because you have to go through a lot of paperwork.

It’s common for us to think about how to get quick and economical digital financial services that make borrowing easier when we’re in a pinch for money. Through Fintech, machine learning and mobile technology are redefining the face of financial services in developing countries worldwide.

Due to the widespread use of fintech in Nigeria, borrowers with solid credit histories and a track record of financial transactions can now obtain loans within 24 hours of applying.

Because you may need money immediately and have no idea where to find it, this post aims to present the finest online loan apps in Nigeria to get instant credit. So get a hot beverage, cozy up, and read on for more information.

The following are the best loan applications in Nigeria that allow you to get a loan quickly and easily.

Top 6 Loan Apps in Nigeria For Quick Loan

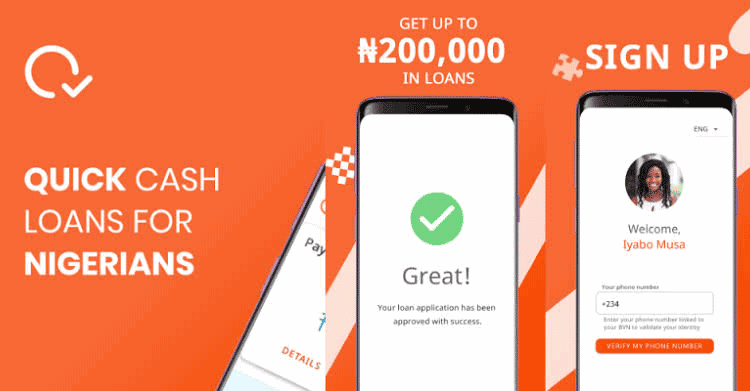

1. Branch

The Branch loan platform is the best and quickest loan app in Nigeria. We have tested them, and you can repay your loan in 2 months as a first-timer with very low interest rates. Another thing about it is that it doesn’t just work in Nigeria; it also works in Kenya, Mexico, and India.

The Branch makes it easy for you to get loans for whatever you need, whenever and wherever you want.

You can sign up in less than a minute, apply for a loan, and have the money sent straight to your bank account. It’s a fast, easy, and reliable way to get cash quickly, even in an emergency.

To apply, all you need is your bank verification number (BVN), bank account number, and your phone number or Facebook account. In addition, to construct your credit score, they will ask for access to the information stored on your phone.

You can use the Branch loan app to borrow between 1,000 and 200,000.

2. Okash Loan

Okash is our second choice. It has a very low-interest rate but a little delay in processing the loan; at least 6 hours in our case. A loan of up to 50,000 Naira can be obtained with the Okash Loan, also known as the Opay Loan. It doesn’t necessitate any supporting papers or collateral.

In order to apply, you must download the Okash mobile app, open an account with your personal information, and then wait for the approval. Within 24 hours, you’ll receive a confirmation call followed by your loan.

3. FairMoney

A loan from FairMoney might be for as long as 18 months and up to 1 million Naira. To be eligible, you must have an Android phone and a BVN. Download the FairMoney app from Google Play as well. The phone number linked to your BVN must be used to sign up.

Documents aren’t necessary when using FairMoney. When you apply for a loan, you will simply need to provide us with your BVN number and your bank or credit card information so we can debit your account for the repayment.

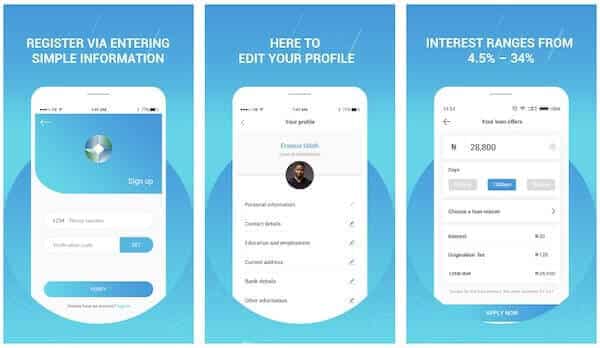

4. PalmCredit

Palmcredit is also one of the top 5 applications for getting a loan in Nigeria. You can get a loan for as little as 2,000 and 100,000 from the Palmcredit app.

You can get the PalmCredit loan app from the Playstore or find out more about it on any of PalmCredit’s social media sites.

Loan Duration

It gives loans for between 91 and 180 days. The interest rate can be anywhere between 14% and 24%. If you want to borrow $100,000 for six months, you will have to pay back $124,000.

Students at least 18 years old can apply for a loan through Palm Credit.

The problem with PamCredit is its very high-interest rates. ARRRHG!

5. Carbon Loan

You can get a loan of up to N500,000 without putting up any security with the Carbon Loan, which was previously known as Paylater. Once your application has been granted, you may expect to get your money within one to three business days after it has been approved. You must pay your debts on time to get a greater credit limit for your next loan.

Carbon Loan out credit facility to everyone working or not, student or monthly pay earner, even entrepreneurs. The online lending app uses your Bank Verification Number (BVN) to determine how much you can borrow. There is a maximum loan amount of N20 million, and the interest rate might change at any time. If you’ve forgotten your BVN credentials, follow these steps to retrieve them.

6. Renmoney

Renovating your home, purchasing a new automobile, paying school fees and medical bills, and expanding a small business are just some of the things you may do with a loan from Renmoney.

You will receive the money in your bank account within 24 hours if your loan application is granted.

There is no requirement for any type of collateral during the application process.

In order to be eligible for a Renmoney loan, you must be:

- 22 – 59 years old

- Have a verifiable source of income

- Live and/or work in cities where we operate

- Have a savings or current bank account with any commercial bank

- You need your bank statement, a government-issued ID card, and a utility bill

NOTE: RenMoney seems to have issues as of the time of testing. Their loan application keeps throwing errors.

Other Loan Apps You can Try in Nigeria

Below listed Nigeria loan apps are not tested or recommended by us. Users are to download and use at their own risk.

7. QucikCheck

QucikCheck uses machine learning to predict the behavior of borrowers and rapidly analyze loan applications. If you’re eligible, you’ll get your money in your bank account in a matter of minutes. With no collateral, you can borrow as much as $5000 for 15 or 30 days at no interest.

QuickCheck requires your BVN and bank account information for security and verification purposes.

8. Page Financials

Page Financials is a financial company in Nigeria that the CBN licenses to give out personal loans.

The organization says that getting a loan from them is easy and that they have a flexible way of handling the paperwork.

Loan Amount

Loan amounts range from 100,000 yen to 5,000,000 yen, and interest rates range from 3.76 percent to 120 percent per month and from 29 percent to 120 percent per year.

Loan Tenure

The length of the loan is between 60 and 180 days, and you can choose to pay it back manually or through the auto-debit service.

9. Jumia Loan

Jumia Loan allows you to get up to N500,000 from your phone to make everyday living a little bit more convenient. If you solely use the JumiaPay Android app, you’ll have access to larger loans with cheaper interest rates in the future.

How to Apply for Jumia Loan:

Please follow these procedures to apply for a Jumia Loan:

- Visit the JumiaPay Android app

- Scroll down to the ‘Financial Services’ section and click ‘Loans’

- Provide all the requested information

- Approval takes a few minutes and you get an email requesting your details for disbursement

- Once you provide your details, the loan is paid into your account instantly

10. Specta Loan

You may borrow as much as $5 million through Specta, an online lending platform, in as little as 5 minutes! There is no collateral, paperwork, or office visit required.

When you have Specta on your phone, you can take care of personal or commercial emergencies on the go. Loan interest rates range from 25.5 percent to 28.5 percent. For Insurance, a one-time payment of 2.5% is required. Management fees are paid in one lump sum at a rate of one percent. 1 to 12 months of repayment. 1% of the total fine.

11. Migo Loan (KwikMoney)

Migo, formerly known as Kwik Money, allows borrowers to get loans of up to N500,000 without putting up security. Interest rates on Migo loans range from 5 to 15%, with repayment terms ranging from 14 to 30 days.

You can visit their official website at Kwikmoney.com to complete the loan in seconds using only your phone number and have the money deposited directly into your bank account.

12. Credit Ville

Those who qualify can obtain Payroll-based consumer loans from Creditville, an online moneylender. After then, a portion of your monthly take-home pay is withdrawn to pay back the loan. An urgent or emergency loan of up to NGN 100,000 can be swiftly deposited into your bank account if you meet the terms and restrictions of this loan app.

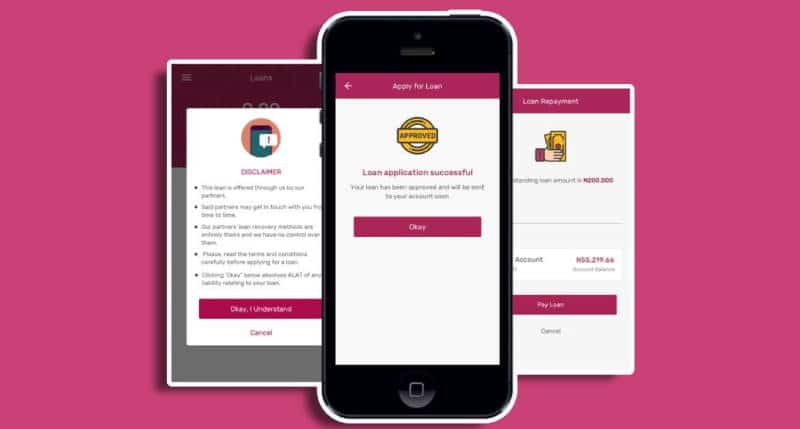

13. ALAT Loan

ALAT is now Nigeria’s leading digital bank. Without collateral, you can now borrow up to N2,000,000 (Two million naira). ALAT’s Payday Loan is available to both new and existing customers. However, there are some conditions that must be met in order to receive an ALAT Payday Loan.

Those who are employed will be eligible for a loan up to the amount of their monthly paycheck, with a repayment period of one month (i.e, before the next salary payment day). Payday loans have a 2% interest rate.

14. Aella Credit

Aella Credit is another loan app in Nigeria that offers quick loans. It offers loans of up to $1 million with interest rates that range from 6% to 20%.

The loan is for 1–3 months, and there are no fees for being late or rolling it over.

You can get the software from the Android Play Store, the Apple App Store, or both (iOS), Fill out all the information needed to use the app and get quick loans wherever you are.

Make sure your details are correct and match the information you gave, because if they aren’t, you might not be able to use the app.

15. SokoLoan

A microfinance institution like Soko Lending Company Limited wants to make it easier for poor people to get financial services by giving loans to low-income businesses, students who are still in school, and other people.

Sokoloan is a simple app that can be used to get short-term loans in Nigeria at any time of day or night.

The more quickly you pay back the money you borrowed, the more you can borrow. As a student in Nigeria, you can always use the Sokoloan platform or app to get a loan right away.

16. KiaKia Loan

The KiaKia Platform is another safe way for people in Nigeria to borrow money and get loans right away. KiaKia means “fast fast” in Yoruba country, which is in Nigeria. This means that giving money is a quick process.

KiaKia Money can give you a loan if you are a student who needs to pay your school fees for the semester or a business owner who needs money to grow.

By dialing *822# on your cell phone, you can get a loan from Sterling Bank, which is in charge of Kiakia loans.

To start the loan process, all you have to do is go to the Kiakia website (kiakia.co) at any time of day.

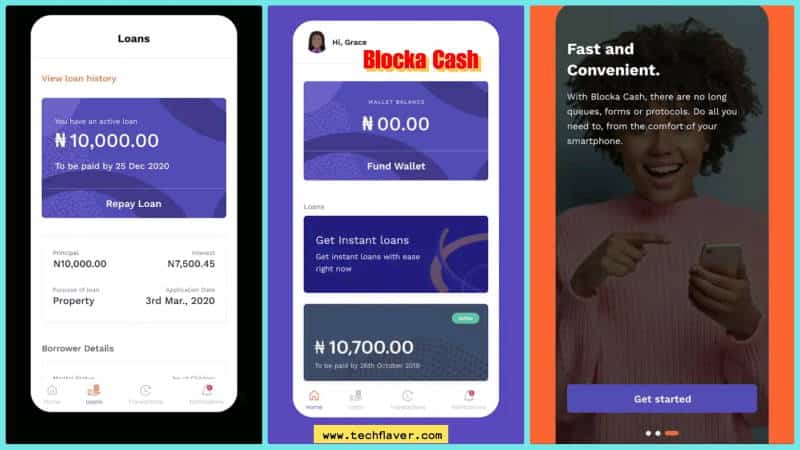

17. Blocka Cash

Blocka Cash makes it easy and convenient for Nigerian students to get loans. Blocka Cash can be found in both the Apple App Store and the Android Playstore.

Depending on your past payment history, you could get a short-term loan from Blocka for as little as 5,000 or as much as 50,000.

To apply and participate, you must be at least 21 years old. You could also. You might have to show a valid government ID. You might have to show a valid government ID.

The main features of Blocka Cash include:

- Loan tenure: 60 to 180 days.

- Rate of interest: 3% – 10% per month

- iOS, Android,

- Loan Amounts: ₦5,000-₦50,000

- APR (Annual Percentage Rate): 36% to 120%

18. Lidya

Lidya was one of the first loan apps in Nigeria that helped small and medium-sized businesses get fast, secured loans online.

Loan Amount

The platform gives businesses credit of between 500 and 50,000. The amount of this loan is just what you want.

Lydia looks at how much money a person or business needs to get a loan. This evaluation is used to give each business its own unique credit score.

Lydia also gives out loans in less than 24 hours. The loan amount determines how long you have to pay back the loan, and you can’t get more than one loan at once.

Debit cards and direct deposits are two ways to pay. And as a student or salary earner, you need to own a business to be eligible for this loan.

19. Newcredit

Another app in Nigeria that provides rapid loans and has more than 1 million downloads is called Newcredit. The mobile loan application allows Nigerians to borrow up to N300,000 without having to put up any collateral. The app employs artificial intelligence (AI) to examine the financial records of prospective clients. This includes the bank transaction SMS on the users’ phones as well as their credit worthiness as determined by other lenders.

20. Umba instant loan app

The 7th best loan app in Nigeria is Umba, which enables users to apply, draw down, and repay loans. Once a person’s identity has been confirmed, Umba uses a risk assessment to make loan choices.

In addition to mobile loans, Umba is also a full-fledged mobile bank. To expedite loan disbursement, Umba, available 24/7, eliminates the need for documentation, collateral, or in-person visits.

You may use your Umba loan to transfer funds straight to your M-Pesa account, retailers, and utility service providers.

Umba does not impose late fees or rollover costs, and you may have access to larger loans, reduced rates, and more flexible payment terms as you repay. It uses your phone’s data, including your SMS history, to authenticate your identity and generate a credit score, making obtaining a personal loan straightforward.

As one of the best loan apps in Nigeria, Umba also ranks among Nigeria’s most secure, as they prioritize your privacy and pledge never to share your information with other parties.

There is a maximum term of 62 days for Umba loans, with a minimum loan amount of 1,115 NGN and a maximum sum of 89,182 NGN. The maximum APR is 10% with no commission or VAT.

Several automated variables determine your loan offer: as you continue to make repayments, the loan amount will rise over time.

How to borrow from the Umba instant loan app

- Install the app using the installation button above

- Create an account

- Apply within minutes.

- Receive an Umba Loan

- Increase your borrowing limit whenever a loan is repaid on time.

A list of the finest loan applications for Android and iOS in Nigeria.

- Carbon (formerly known as PayLater)

- FairMoney (by WEMA)

- Branch

- Palmcredit

- RenMoney

Benefits of online loans in Nigeria

Quick and simple to obtain in a matter of minutes, online loans offer a number of advantages that set them apart from traditional loans and make them a desirable alternative in many situations. The following is a list of some of the advantages of online loans:

- Easy availability

- Unrestricted availability 24 hours per day, 7 days per week

- No collateral or papers required

- Quick disbursement

- The funds will be deposited directly into your account.

What to know before getting an online loan in Nigeria

Please note that each loan application has its own terms and conditions. Therefore, you must read and comprehend the requirements before applying. In addition, it typically includes interest rates, penalty fees, and other loan restrictions.

Conclusion

There are many apps that students in Nigeria can use to get instant loans online, but I can’t list them all. That’s why I’ve decided to list the top 20 best apps and platforms you can use to get instant loans.

But you should know that if you want to borrow money, especially for business, you should plan everything out carefully so you don’t get into debt. If you want to borrow money for personal reasons, you should ensure you have the money to pay it back on time because of interest.

Add this post to your bookmarks so you can recheck your choices later. If you know of any other quick loan apps for students, please let us know in the comments.