Have you ever had little money? If you have bad credit, you’ll never be able to pay your credit card or utility bills. Help is available for people, families, and homes that are struggling.

Content Recap:

People with bad credit histories have either made financial mistakes in the past or haven’t had enough time to build up a credit history. Loans like these can be either unsecured or secured (backed by property such as a house or car). Lenders offer different terms, fees, and interest rates for these loans.

Many banks, credit unions, and online lenders offer loans for people with bad credit in the UK, but each has its own rules about who is a “creditworthy borrower.” When looking for a loan, it’s important to compare all the lenders carefully because some have stricter rules than others.

We have put together a list of 22 loans for people with bad credit in the UK that we think are the best.

Take the time to read and understand the interest rate that will be added to the loan payment, and then choose the option that works best for you.

List Of Available Cash App Bad Credit Instant Loans In The UK

Here is a list of the 22 best instant loans for bad credit in the UK that we recommend. Just choose the one that fits your needs and interests you the most.

- 1. Cash Float

- 2. Mr. Lender

- 3. Quick Quid

- 4. Piggy Bank

- 5. My Jar

- 6. Peachy

- 7. Swift Money

- 8. Harris Finance

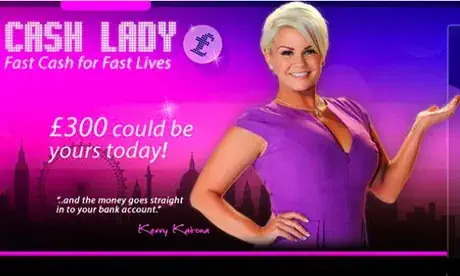

- 9. Cash Lady

- 10. Cash4unow

- 11. Oyster Loan

- 12. Money Boat

- 13. Cashasap

- 14. Fast Loan

- 15. Simply Money

- 16. THL Direct

- 17. Sunny

- 18. Lending Stream

- 19. Creditstar UK

- 20. Viva Loans

- 21. Loan Pig

- 22. Scot Cash

1. Cash Float

The loans available to Cashfloat clients will be larger and have more favorable repayment terms. It’s possible that these loans could help people with average credit histories escape the trap of repeatedly taking out payday advances. It’s one of the financial technology apps that provides subprime loans in the UK.

Instead of taking out smaller payday loans to meet unexpected expenses, these loans may provide more long-term financial relief. Personal loans from Cashfloat are more manageable due to their lower interest rates and flexible repayment schedules.

To apply, your minimum age must be 18. Each loan from Cashfloat must meet strict criteria for affordability, application verification, etc., as part of their responsible lending policy. It can take up to 30 minutes to make a loan decision during business hours. The money will be deposited into your account on the same day if authorized. Clients new to the bad-credit loan market in the UK can borrow up to £700 with a payment schedule of 6 months.

To Apply For Cashfloat Loan, click here

2. Mr. Lender

Mr. Lender is a short-term loan company based in Loughton, England that helps people in need get small amounts of cash quickly. The lender will work with anyone who wants to borrow money, even if they have bad credit, but they will only give loans to people who can pay them back.

The first step is to go to the lender’s website, decide how much you want to borrow and for how long, and then use the calculator on the site to get an idea of how much you will have to pay back. Those who want loans but have bad credit in the UK can start with up to £500.

To Apply For Mr. Lender Loan, click here

3. Quick Quid

QuickQuid is owned by Enova International, a successful online lending and analytics business with 11 brands in six countries, including the UK and the US.

With its main office in London, QuickQuid has given short-term loans of up to £1,500 to more than 1.4 million people in the UK. They give loans to people with bad credit in the UK and to some people who aren’t as qualified.

Most QuickQuid loans last between one and three months. You can choose the solution that works best for you based on how much money you have.

To Apply For Quick Quid Loan, click here

4. Piggy Bank

PiggyBank gives people with bad credit quick, flexible payday loans and installment loans with terms as short as 7 days and as long as 5 months. You will make monthly payments if you choose to spread the payments out over two months or more. Each payment will cover a portion of the capital (the amount you borrowed initially) and the interest that has already been added.

The Financial Conduct Authority (FCA) told PiggyBank to stop giving out loans in the middle of 2019. The FCA worried about how well the lender checked borrowers’ ability to repay loans. After an investigation, PiggyBank was given the go-ahead to start lending again.

To Apply For Piggy Bank Loan, click here

5. My Jar

The London-based company My Jar is a direct lender. My Jar has been in business since 2009 and offers short-term loans to people in the UK with bad credit. At this point, 2.3 million loans have been given out by MyJar.

People with bad credit histories who might have trouble getting loans elsewhere could get loans through MyJar. MYJAR gives out loans ranging from $100 to $2,000 per month. There are three ways to pay, which can be spread out over 3, 6, or 12 months.

To Apply For MyJar Loan, click here

6. Peachy

Peachy is a short-term and installment loan service for people in the UK with bad credit who need cash quickly, either between paychecks or in an emergency.

New users can request loans of between £100 and £1000. If your application is accepted, you can choose to pay back the loan over one to twelve months.

The money must be paid back on time. If you don’t pay, you might have to pay a default fee or more interest, which could come back to haunt you. If you can’t make your payments on time, you should contact the loan company immediately and let them know.

To Apply For Peachy Loan, click here

7. Swift Money

Swift Money is a company that is growing and helping more and more people get payday loans. They offer fast short-term loans, but you should only use them as a last resort because the interest rates are so high. Caution: If you don’t pay on time, you could get into trouble with your money.

Swift Money has one of the quickest and most effective ways to process loans, so people with bad credit have a very good chance of getting loans of up to £3,000. If one of our lenders agrees to give you a loan, the money can be in your bank account in as little as 10 minutes.

To Apply For Swiftmoney Loan, click here

8. Harris Finance

Harris Finance can set up secured and unsecured personal loans for people with bad credit in the UK at affordable rates. Because they don’t use computerized credit scoring systems, they can give loans to people who might not have been able to get one otherwise.

For more than 50 years, Harris Finance has helped Scottish businesses and people get loans. They know what to do and have the skills and knowledge to help you in any situation. Harris Finance is a business run by a real Scottish family.

Few people take the time to really get to know their customers and understand their needs.

Their commitment to customer service shows how much they care about each person. Giving out loans starting at €1000. They are always looking for new and interesting ways to help their clients reach their goals. People who need loans for bad credit in the UK are also welcome.

To Apply For Harris Finance Loan, click here

9. Cash Lady

If you use cashlady.com to apply for a loan, you should hear back in about two minutes. The time it takes for your money to get to your account depends on your bank’s policies and procedures.

If the loan is approved, the money can often be in your account within minutes. People who want loans for bad credit in the UK can get help from Cash Lady. The amount of help they can get ranges from €1200 to €5000.

The first thing you need to do to get a loan from CashLady is to fill out the online application form correctly. The rest of the hard work will then be done for you by them. Cash Lady in the UK can give you a loan even if you have bad credit.

To Apply For Cash Lady Loan, click here

10. Cash4unow

Cash4unow is an independent company that offers installment payday loans. It was founded in 2011 and has its main office in Leeds.

They want to move the short-term lending industry forward with their flexible and responsible lending methods because they think people should have more ways to help them manage their money. Cash4unow is a reliable loan company because customers from all over England have given it good reviews and ratings.

Cash4unow has a high APR because it is in the high-cost short-term loan market. For a start, you can get a loan of up to £500. If you pay it back on time, you’ll be fine.

To Apply For Cash4unow Loan, click here

11. Oyster Loan

A company in the UK called Oyster Loan helps people find offers from licensed lenders for short-term, unsecured personal loans. They offer loans for people with bad credit in the UK and are here to help you find the best lender who will give you the money you need to deal with your financial problems.

Let’s look at a $2,600 loan that is approved for 36 months. The rate of interest is 41% per year (fixed). An APR of 49.7%. The total amount owed is £4,557.89, and £1,957.89 of that is interesting. Each of the 35 payments will be worth £126.61, and the last payment will be worth £126.54.

To Apply For Oyster Loan, click here

12. Money Boat

If you are thinking about getting a payday loan, MoneyBoat might be able to help you. The direct lender is reliable, honest, and willing to work with you. It gives short-term loans to people in the UK with bad credit for 0.7% per day in interest, while most other lenders charge 0.8%. (which is the price cap set by the FCA).

To make it easier for you to pay back your loan, they also have customer service in the UK and let you pay it back in more than one installment.

To Apply For Money Boat Loan, click here

13. Cashasap

With their online service, you can apply for a loan over a range of time periods, giving you control over how much you pay back and letting you choose the best option for your needs. They offer two kinds of credit: payday loans and long-term loans for people with bad credit in the UK.

First-time users who want to borrow money with bad credit in the UK can only get a loan of £400. This limit could go up to £750 if you make your payments on time and stay eligible for a cashasap.co.uk loan. You can get a loan with a maximum term of 6 months or a payday loan with a maximum term of 35 days.

To Apply For Cashasap Loan, click here

14. Fast Loan

At Fast Loan UK, you only have to choose how much you want to borrow, how long you want to borrow it, and how many times you want to pay it back. If you can, you can choose to pay back your quick, cheap loans for bad credit UK, which go up to £500. If you don’t pay back on time, you’ll only be charged interest for the days you borrowed.

All lenders say it takes a few days or less to fund a loan. But people with bad credit can get loans fast. They can use the money for everything, from moving costs to car repairs. Online lenders are fast and easy to get in touch with. If you qualify, some of them might give you money on the same day or the next day.

To Apply For Fast Loan UK, click here

15. Simply Money

Simply Money can help you find the best rates on secured loans, consolidation loans, unsecured loans, and loans with a guarantor. No matter your situation, Simply Money also has loans for people with bad credit in the UK. Today, you can apply for a loan online from £500 to £35,000 without paying anything upfront.

Loan terms can be as short as 12 months and as long as 60 months. Rates between 5.8% APR (the lowest) and 89.9% APR (highest). This has enabled us to help people with different kinds of credit.

Lenders will give out loans of up to £25,000 if they can afford to. The percent APR rate that you are given will depend on your specific situation.

To Apply For Simply Money Loan, click here

16. THL Direct

THL Direct is a short-term lender with high fees that gives loans to people with bad credit in the UK. They offer 3-month payday loans, but you can pay them back early without any fees and only pay interest for the time you borrowed the money.

THL Direct charges a daily interest rate of 0.8%, which is about the same as what most expensive short-term lenders charge (in line with the FCA price cap). There are no fees for taking out the loan, not making payments, or paying it back late.

When your application is complete and the loan is approved, THL direct lender partners can give you money the same day. The money goes right into your bank account.

To Apply For THL Direct Loan, click here

17. Sunny

Sunny advertises itself as a provider of quick and flexible loans for people with bad credit in the UK. It offers short-term loans to customers and puts a lot of emphasis on providing a fair service.

Sunny Loans is run by a company called Upward Finance Limited. This company is an introducer appointed representative of Flux Funding Limited, which is not a lender but a credit broker. Their official business name is Sunny Loans. The length of a loan can be between three and six years.

Sunny is a well-known short-term loan company in the UK. It has been in business there since 2004. Sunny lets people apply for loans with amounts between £100 and £2,000.

To Apply For Sunny Loan, click here

18. Lending Stream

Since 2008, UK customers have been able to borrow money online from Lending Stream, a direct lender of short-term loans for people with bad credit. They do business under the name GAIN Credit LLC and provide credit solutions under the name Drafty.

New customers can ask for loans between £50 and £800 while returning customers can ask for up to £1,500. How well previous loans were managed will be a big part of whether or not you get the loan.

To Apply For Lending Stream Loan, click here

19. Creditstar UK

Creditstar is a new financial technology company that helps people with bad credit get loans from private individuals. Since they began in 2006, their goal has been to make borrowing easy and available to everyone. They have more than 1 million registered users and work in eight European countries.

Customers who want to borrow for the first time or who have bad credit can borrow up to £600 and pay it back over 30 to 6 months. You can choose a date that works for you each month to ensure you pay back the loan on time.

To Apply For Creditster UK Loan, click here

20. Viva Loans

If you need bad credit loans in the UK, Viva loan is something to consider if you need money quickly. You can find a way out if you have a few hundred pounds. Consider medical emergencies, unplanned travel costs, car repairs, home renovations, special events, unexpected cash problems, or delayed paycheques. All of these things can be helped by a Viva loan.

Vivaloan is an online marketplace for personal loans that work with many different lenders to offer loans from $100 to $15,000.

To Apply For Viva Loan, click here

21. Loan Pig

About short-term loans for people in the UK who have bad credit. LoanPig is both a broker of credit and a direct lender for people who need help with an unexpected financial emergency.

How to apply is quick and easy. Enter your personal information, income information, and costs, and we’ll do our best to find you a lender for a short-term or payday loan.

The annual percentage rate (APR) is 1261 percent, and customers can borrow from £50 to £1,500 for 1 to 12 months (a daily interest rate of 0.80 percent).

To Apply For Loan Pig, click here

22. Scot Cash

Scotcash is a brand-new community interest company set up in October 2006 to help people who are having trouble with money and offer loans for bad credit in the UK.

The CIC was started with money and help from the Glasgow Housing Association, the Glasgow City Council, the Royal Bank of Scotland, the Scottish Government, and Communities Scotland. This government group no longer exists.

In just 18 months, Scotcash has given loans to 1,500 people with an average interest rate of 20% to 25%.

To Apply For Scot Cash Loan, click here

FAQs on Bad Credit Loans In the UK

Can I Get A Loan With Extremely Bad Credit in the UK?

Loan companies know that sometimes people with very bad credit need to borrow money. When customers ask, “Can I get a loan even though I have bad credit?” They now get a more positive answer.

Even if you need a loan to pay for something unexpected, like a car repair bill or a heating engineer bill because your boiler broke, loan companies will still give you access to reasonable loans for bad credit in the UK. However, some loan companies may insist that you start with a small amount.