One of the best-known apps for paycheck advances and budgeting help is called Dave, but it’s far from the only one; there are a number of other apps that offer similar functionality, often with slightly different features and conditions.

Content Recap:

I’m going to show you some of the best cash advance apps on this page that are excellent Dave alternatives. Here are the top Dave-like money apps:

11 Best Cash Advance Apps Like Dave

These apps can assist you in receiving payment today and in receiving your paycheck early.

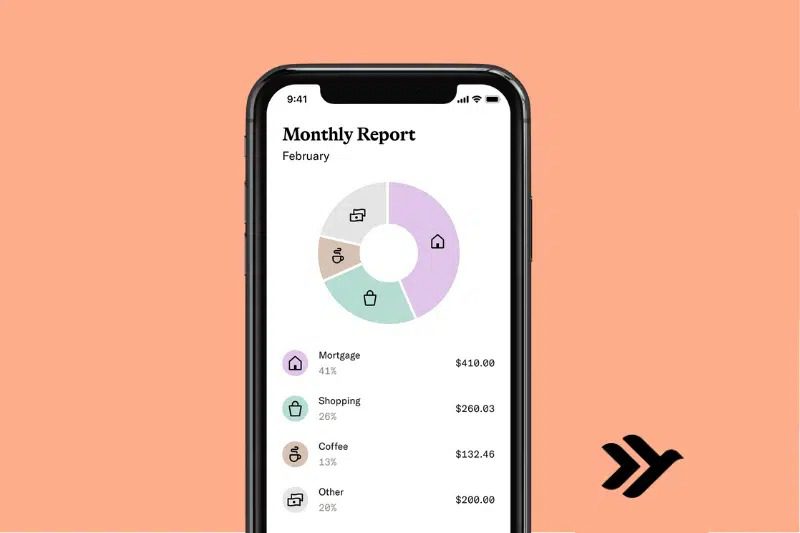

1. Albert

Our top choice for the best alternatives to Dave money app is Albert. Users of this platform can borrow up to $250 in cash without being charged late fees, interest rates, or credit checks.

For those in need of a small loan to handle one or two problems quickly, this app is a great option. On this platform, you can get cash quickly if you need it in 2 to 3 days for free, or you can pay a small fee to get it immediately.

Pros

- Amount: up to $250

- Fee: $0

- Interest rate: 0%

- Waiting period: Immediately for a small fee, or wait for 2-3 days for free

- Credit check: No

Cons

- $4.99 for an instant cash advance

2. MoneyLion

This is yet another excellent banking app that enables you to borrow quick cash to handle urgent financial matters. You must have an account with MoneyLion that is at least two months old in order to be eligible for a loan.

Similar to Albert, there is no additional interest rate and no need for a credit score to get a loan from MoneyLion. However, a “Turbo Fee” will be applied if you need your money right away. For a RoarMoney Account, cash delivery typically takes 12 to 48 hours, whereas it could take up to 3 to 5 business days for a regular bank account.

Instant cash advance fees for RoarMoney accounts can be as high as $5.99, while they can be as high as $7.99 for external cards and accounts.

Pros

- Amount: $25 up to $250

- Fee: $0 for standard rates

- Waiting period: 12-48 hours

- Credit check: No

Cons

- Instant cash advances a “Turbo Fees” is applied.

- There is no effect on credit scores.

3. Earnin

The only service on this list that enables users to access their earnings from work before payday is Earnin. Based on the user’s position in the earning cycle, it determines the portion of their paycheck that is redeemable.

Assume a user receives payment on a monthly basis and has finished half of the work for that month. Before payday, they can claim their pay. There are some restrictions, though. A daily redemption cap of $100 and a maximum early claim per pay period of $500 are both permitted.

A user also has the choice of receiving a paycheck two days earlier if they choose not to use this service. Customers can tip Earnin for services even though there are no direct user fees.

Pros

- No fees

- Two-day-early paycheck

- Up to $500 cash advance

Cons

- Bank fees can apply to “Lightning Speed” payments

- Only available to U.S. citizen

4. Empower

One of the best payday loan apps like Dave is called Empower. It was created for the current generation. Whatever comes, they’ll enable you to prosper by letting you borrow money. You can save money for the future and get a cash advance of up to $250 by downloading the app.

They’ve got your back, and they’ll deposit a cash advance of up to $250 into your account. There are no applications, interest charges, late fees, credit risks, or applications. Simply repay them automatically when you get your subsequent direct deposit. Nothing is a catch. It’s that easy.

5. Cleo

You can get a salary advance with Cleo as part of the Cleo Plus subscription service, which is its response to outrageous overdraft fees and the frighteningly expensive world of payday loans.

If you meet the requirements, Cleo may grant you a no-interest advance of up to $100 to assist you in avoiding an overdraft. You choose your repayment window, which can be anywhere from three to twenty-eight days, and you pay Cleo back on that date. Your credit score won’t be impacted, but Cleo Plus costs $5.99 per month. The salary advance feature is not available with the free option, but you do have access to Cleo’s digital wallet and budgeting tool as well as a weekly quiz with the chance to win cash rewards.

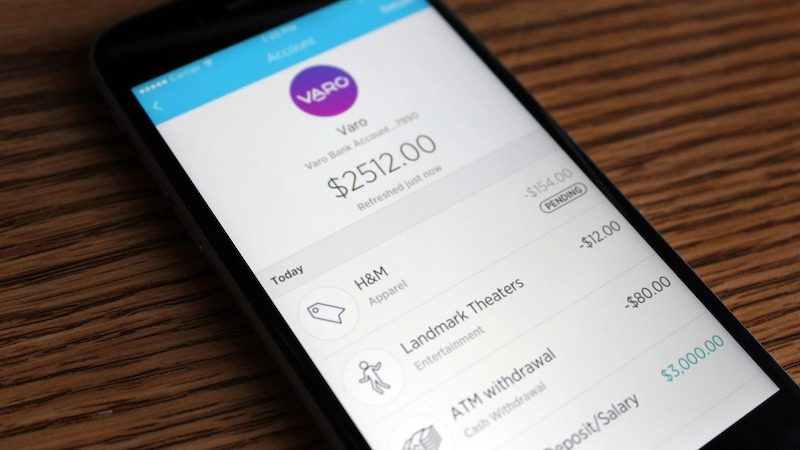

6. Varo

In comparison to the other apps on our list, Varo’s cash advance offering might seem underwhelming. With a 30-day repayment period, Varo offers cash advances ranging from $20 to $100. Sadly, there is a fee of up to $5, depending on the sum of your advance, and you need to have a Varo bank account that has been open for at least 30 days.

Varo, on the other hand, is a choice to take into account if you’re looking for an app that offers complete banking services as well as the opportunity to apply for small cash advances. There are no monthly fees, no foreign transaction fees, and more than 55,000 fee-free ATMs available through Varo.

The Varo Believe Credit Card, which has no annual fee, no APR, no minimum security deposit requirement, and no credit check can also help you build credit at your own pace.

Pros

- Two-day-early paycheck

- Up to $100 cash advance

Cons

- Only available to U.S. citizens

- 5% Interest rate included

7. Chime SpotMe

Overdraft fees collected by traditional banks totaled $11 billion in 2019. Chime operates in a unique way. They don’t impose an overdraft fee on you; you are free to go overdrawn up to $200*. So even if you are in need of a purchase but lack the necessary funds, you can still make it thanks to Chime SpotMe. Chime is a flexible option for any customer because it integrates with so many different apps.

8. SoFi

Based in San Francisco, SoFi Technologies is an American online bank and personal finance company. SoFi has much higher limits because it is a bank. Each day, members have access to $1,000 in cash advances, with a $40 minimum.

Larger cash advance options are subject to standard fees. The greater of these two amounts—either $10 or 5%—is charged as interest. Additionally, SoFi members can receive their paychecks up to two days early.

Pros

- Large cash advance payments are available

- Two-day-early paycheck

Cons

- Must have a SoFi credit card

- Higher fees than most

9. Brigit

Another instant loan app that can assist anyone in getting paid today is Brigit. You can join the 3 million members who get paid up to $250, budget, and save money more wisely with Brigit by downloading the free app on iOS or Android. takes only two minutes. You can get your finances in order with Brigit since there is no credit check and no interest.

10. Klover

You can get some extra money before payday with apps like Klover. If you meet the requirements—having received at least three regular direct deposits from the same employer over the previous two months without any pay gaps—you can apply and ask for a $100 cash advance.

11. Branch

For working Americans, apps like Branch provide a mobile digital wallet. This get paid today app enables any employee to receive a payroll advance (up to $500 in earned wages per paycheck), manage their cash flow, and spend anywhere—all from their smartphone. It serves as an on-demand hub that assists them in meeting their daily financial needs.