Want to know how to activate North Lane login.wirecard.com? Read on to learn about it.

Content Recap:

The team at Wirecard has been looking for an easy way to activate their cards, but they haven’t found the right place yet. We know how hard it is to deal with your problem, so we’ve come up with the right steps so you can easily finish this process at the login page on Wirecard’s website.

We wrote this article to help you use any phone, at home or on the go, to activate Wirecard North Lane NFC cards. We’ll show you how to do this with Android phones and iPhones, even the iPhone 7. Before moving on to offline activation, you also need to finish two security steps on your home computer.

Wirecard is the first company worldwide to combine NFC technology and smart card functions successfully. With the North Lane solution from Wirecard and its state-of-the-art security standards, customers can process online payments without having to pay high card processing fees.

Contactless Payments – All About Transactions

The Visa or MasterCard network will process today’s contactless payments in a matter of seconds. Up to four cards can be used at once at a contactless payment terminal. This means that mobile NFC payments are fully scalable and can either replace wallets built into devices or be added as an extra payment option to improve the customer experience and make more money.

Intelligent Processing – All About Speed

Processing fees for contactless payments are often higher than fees for traditional card transactions. Still, Wirecard’s North Lane solution lets clients cut this charge, usually by about 50 percent. This is done through an intelligent platform architecture that evaluates each transaction on multiple levels. So, merchants who accept contactless payments with Google Wallet or Apple Pay at the checkout can save a lot of money and feel safer with payment systems that use North Lane technology.

Business Benefits

Wirecard’s North Lane solutions help merchants in many different fields, such as retail, finance, hospitality, transportation, and communications. These benefits are gained from using contactless payment-enabled devices or apps without needing expensive system upgrades.

This means that the solution can be put in place quickly and cheaply, while giving merchants access to advanced security features that are much better than any other wallet system on the market today.

Security

Wirecard’s platform is safe because it uses point-to-point encryption (P2PE) that is certified by EMVCo to protect cardholder data during transactions. Also, sensitive card data is encrypted and stored in data centers that meet the Payment Card Industry Data Security Standard and are PCI-certified and state-of-the-art. This happens as soon as a transaction is made.

Mastercard Contactless Mobile

Wirecard’s North Lane solution gives clients worldwide access to MasterCard’s contactless mobile payment technology. So, merchants can grow their businesses by allowing customers to pay with their NFC-enabled smartphones or other devices that work with them at the register.

This is because Wirecard’s solutions allow for merchant-branded mobile apps — such as those offered by thousands of merchants in Europe and South America — to be added to process payments without having to incur fees like swipe and signature costs.

Google Wallet And Apple Pay In Retail Stores

If you accept contactless mobile payments through Google Wallet or Apple Pay, you can also accept payments from customers with devices that have NFC. Also, merchants are not required to have their own payment app for mobile devices. Wirecard’s North Lane solution can be used in brick-and-mortar shops and online stores because it works with all major virtual wallets.

Masterpass Online

Wirecard’s North Lane solution also lets online Masterpass transactions be made without touching the card. Masterpass is the infrastructure that MasterCard made for digital wallets. It makes it easier and faster for people to pay at checkout. This means that merchants can offer their customers a better experience during the checkout process while also making the process safer and saving money on processing costs.

How Does Wirecard’s North Lane NFC Work?

Wirecard is a German FinTech company that helps people pay for digital goods and online games with financial and software technology services. Wirecard’s North Lane solution lets its clients add contactless payment technology to their products at a fraction of traditional solutions’ cost without investing in new infrastructure.

For North Lane’s payWave transactions to work with Android phones, customers must download the Wirecard mobile wallet app from the Google Play Store. For this process, you need a smartphone or tablet with NFC technology to register your card just once. After that, you can use it right away.

The Wirecard mobile wallet app also has other features, like an online shopping function and an in-store Store Locator function that lets customers search for stores nearby that accept payments through the service, both locally and around the world, all from within the same app.

- Log in to Wirecard

- Choose “Activate North Lane“

- Fill out the activation form with your name, email address, and phone number

- Enter the verification code you received via text message or email

- Click on “Submit” when done

- Your account is now activated! You can start using it immediately for online purchases and withdrawals from any ATM worldwide that supports MasterCard cards (including Bank of America ATMs) as well as at retail stores such as Best Buy, Macy’s, Sears, and Walmart by presenting your card to a cashier at checkout; For international transactions, don’t hesitate to get in touch with us for more information about fees and rates associated with these transactions.”

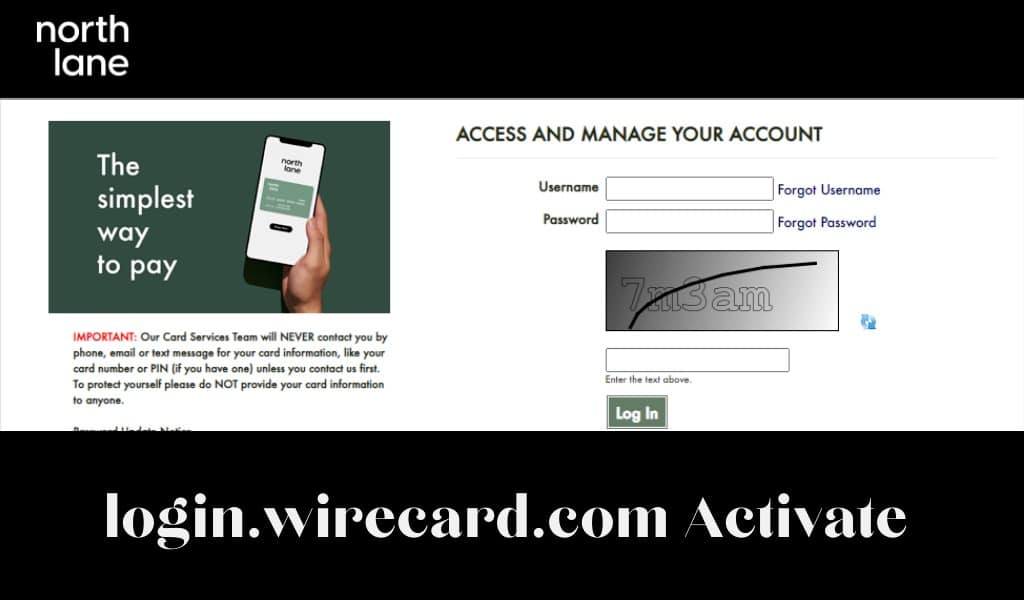

Sign in to Access and Manage Your Account

- Go to login.wirecard.com.

- Enter your username and password.

- Click “Login“

- You will now be logged into the Wirecard North America website

- Once you have submitted your registration, you can manage your new Wirecard account from within the Wirecard North America portal by clicking on “Activate New Card” during login procedures and checking recent activity on the main dashboard screen of the site.

If You Forgot Username – Try these Solutions.

- Try to log in with your email address and password. If that does not work, please call Wirecard North America customer service at 1-855-946-4332 for assistance.

- Or you can also try to click the “Forgot Password” link on the login page and follow the instructions there.

If You Forgot Password – Try these Solutions.

- Try to log in with your email address and new password. If that does not work, please call Wirecard North America customer service at 1-855-946-4332 for assistance.

- Or you can also try to click the “Forgot Password” link on the login page and follow the instructions there.

If You Need Help Directly From Wirecard Customer Service – Call 1-855-946-4332 or Select one of the Following Options below:

Contact Wirecard North America Customer Service

- Call 1-855-946-4332

- Visit wirecardcenterusa.com/contact and complete the form and choose the “Wirecard North America” option in the dropdown menu

- You can chat with Wirecard Representatives at wirecardcenterusa.com/livechat

Wirecard’s Mobile Wallet App Offers Multiple Uses for Users

The Wirecard mobile wallet app makes it easy for customers worldwide to use their Wirecard without the need to carry any plastic cards PINs, or other identification materials due to its simple design and user-friendly interface, which allows customers worldwide to use mobile payment technology anytime, anywhere, by simply downloading the app from the Google Play Store after the registration process is complete. This is an ideal choice for users who want to use their Wirecard to manage all their financial needs using one card and app without the hassle of carrying multiple cards or IDs.

1. Use North Lane App to Make Payments At Stores that Accept MasterCard Cards: Users can make payments at stores that accept MasterCard-branded cards simply by downloading Wirecard’s mobile wallet application from Google Play Store on your Android smartphone, after which it will be ready for immediate use at checkout anywhere MasterCard is accepted – including store locations such as Best Buy, Macy’s, Sears, and Walmart nationwide in addition to many more local shops and outlets worldwide.

2. Withdraw Cash from Any ATM That Accepts MasterCard Deposit Transactions: Users can also instantly withdraw cash at ATMs worldwide that accept MasterCard transactions, including Bank of America ATMs, without the need to enter their PIN, choose an amount, or sign for the transaction – all directly within Wirecard’s mobile wallet application.

3. Make International Payments Without Hassles: Wirecard users who want to transfer money overseas using their North Lane account can post a request on the app’s home screen and then specify how much they wish to send along with recipient information such as bank name and address. Once this is done,, wire transfers can be processed immediately without any hassle for added convenience when sending money abroad.

4. Link Card Accounts For Budgeting Purposes: Mobile travelers worldwide who utilize Wirecard for their card replacement needs can also manage their expenses from Wirecard’s mobile wallet application, which includes an easy-to-use dashboard interface that makes it easy to view recent transactions and account balances, among other things.

Additional Information:

Even though there are some fees for using a Wirecard account, users who sign up will have access to more than 500 services worldwide. These include overseas withdrawals from ATMs, including Bank of America ATMs, cash disbursement at POS terminals in shops such as Best Buy, Macy’s, Sears, and Walmart, and many more outlets nationwide. In addition to these benefits, registered users of Wirecard’s mobile wallet app will get personalized customer service for any questions they may have about the app’s many features.

FAQs: login.wirecard.com Activate

What Are The Fees Associated With Using A Wirecard Account?

How many cards do I need to download the app?

There is no need to visit an ATM and inconvenience customers, especially if they are traveling abroad. The service allows customers to receive new cards within 24 hours at their local North Lane locations or through the mail – wherever they happen to be in the world!

Do Wirecard accept all MasterCard Cards?

What If I Lose My Wirecard? Will I Have To Pay For A Replacement?

This enables customers to replace lost or stolen cards with ease and convenience while traveling abroad, saving them the hassle of physically finding a bank branch if they lose their card – something that happens more often than anyone would like during travels!

How Do I Get Access To My Account Funds?

Is There A Minimum Balance Required To Open An Account?

Conclusion

Wirecard’s mobile wallet app is the best way for customers to transfer funds, load their cards, and check balances without waiting in line at a bank or ATM. Because there are so many ways to deposit and withdraw money, customers can easily send money both domestically and internationally.

No matter where you are in North America, Wirecard makes it simple to pay bills, withdraw cash from retail partners such as Walmart, or buy anything online quickly and conveniently! You can also manage your account through our dashboard interface, which gives you all the information you need on the move – something that traditional banks cannot offer as efficiently as we can here at CheckFreePay!

We hope this article has been informative and interesting – if there is any part of Wirecard you would like explained in more detail, don’t hesitate to get in touch with us or leave a comment below!