What is a routing number?

A routing number is a 9-digit code that identifies a financial institution in the United States. It is used for routing money transfers and other financial transactions between banks, credit unions, and other financial institutions. The routing number is also known as an ABA (American Bankers Association) routing code or RTN (Routing Transit Number), and it can be easily located on the bottom of a check or in the online banking portals of financial institutions. The routing number is an important piece of information when transferring money or making payments online. It helps to ensure that the money is sent to the right place and with the correct details. Knowing your bank’s routing number can also help you ensure you are sending money to the right account.

Content Recap:

When you send or receive funds directly from your bank account in transactions such as electronic payments, the bank must know where the funds are supposed to go. The routing number identifies the financial institution where your funds are held and indicates where to send funds that are owed to you. Employers need your routing number to establish payment systems such as a direct deposit.

Typically, banks and financial institutions have multiple routing numbers that serve distinct purposes, geographic regions, and branches. Before initiating a money transfer, it is crucial to ensure that the correct routing number is utilized.

Our database contains more than 20,000 unique routing numbers. This platform is solely for educational purposes. Even though every effort is made to provide accurate information, users must understand that this website is not responsible for how accurate the information is. Only your bank can confirm the accuracy of your bank account details. If you are making an important, time-sensitive payment, you should contact your bank beforehand.

Where is the routing number on a check?

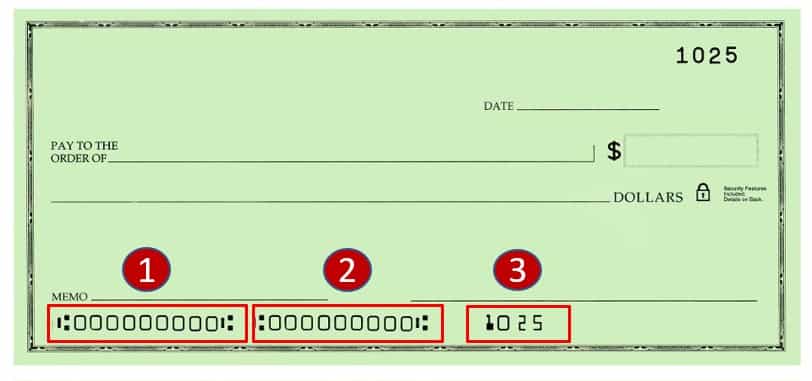

What numbers appear on a check? You will find 3 groups of numbers at the bottom of a check. The first group contains the routing number, the second is the account number, and the third is the check number.

The routing number, which is the first set of numbers in the lower left corner of a check are nine-digit code, and the character symbol surrounding the numbers is not part of the routing number. Routing numbers, also known as transit numbers, are public and may vary depending on the region where your account was opened.

It is helpful to know where to find these numbers when setting up automatic payments for monthly bills and filling out forms for actions such as a direct deposit. Below is more information about routing numbers.

NOTE: In some cases, the order of the checking account number and check serial number is reversed.

When do you need the Access Bank Nigeria routing number?

The Access Bank Nigeria routing number is required in a variety of situations, including setting up direct deposit, automatic loan payments, or recurring transfers like bill payments.

You’ll also need it when you file taxes to receive your tax refund or debit a tax payment, or when you conduct Automated Clearing House (ACH), transfers between different bank accounts.

Generally, you’ll only need your routing number when funds are being directly transferred to or from your bank account — a routing number is never for debit card or credit card purchases.

This number is also used to set up an online account with your bank to be used with personal finance and accounting software.

Access Bank Nigeria routing numbers

We recommend you view the below table in desktop view because, on mobile, you won’t be able to view the complete details.

Make use of the “Search” box to narrow your results by city, state, address, or routing number. You can view all of the information pertaining to the routing number by clicking on the link that is located in the table below (address, telephone number, zip code, etc.).

ABA check routing number digits meaning

The numbers that comprise a routing number can be broken down into 3 parts, each of which has a distinct meaning.

- First 4 digits: The first 4 numbers represent the Federal Reserve Routing Symbol. There are 12 Federal Reserve Banks throughout the US that service a geographic area/district).

- Digits 5 to 8: These are also known as ABA Institution Identifier, these numbers indicate which bank or financial institution within the Federal Reserve District.

- 9th digit: This is the “check digit“. It’s used to verify if a routing number is valid using a mathematical formula.

How to find your Access Bank Nigeria routing number (ABA/RTN)

The following is a list of the various options available to you for locating your Access Bank Nigeria ABA routing number:

- Routing Numbers section of this website: The majority of the major banks in the United States are listed above; you can begin your search there.

- Online banking portal: You will be able to get the routing number for your bank by logging into your online banking account.

- Paper check or bank statement: Checks issued by a bank or bank statements. Check the lower left corner of your check.

- Bank customer service: You’ll be able to get your routing number by contacting your bank’s customer service staff

- Fedwire/American Banking Association: You can look up your routing number on the official website of the Federal Reserve or the American Banking Association.

Always check with your bank or the recipient to ensure that the correct routing number has been provided so that the payment can be processed quickly and safely by your bank.

What is the Automated Clearing House (ACH) number?

The Automated Clearing House, also known as ACH, is an electronic payment delivery system that enables users to electronically send and receive payments as well as collect funds through a network known as ACH. ACH transactions are usually next-day entries when exchanged with other financial institutions. Direct deposits and the conversion of paper checks to electronic versions are both examples of ACH functions.

ACHs were developed to handle high volumes of low-value transactions and charge fees that are competitively priced to encourage the use of the system for the transfer of such transactions. The software was developed to support the acceptance of payment batches, which enables a large number of payments to be processed all at once.

Differences between FedACH & FedWire credit transfers

Accordingly, the following is a comparison of some of the key distinctions that can be made between ACH credit transfers and FedWire credit transfers in the United States.

- Availability: ACH transfers can only be used for financial dealings within the same country. If you want to send money to a foreign country using the ACH network, you will need to make use of an international wire transfer.

- Security: Both types of transfers provide additional layers of protection than what is available when you send a check in the mail. Due to the fact that banking information is encrypted while being transferred, financial institutions that process wire and ACH transfers offer an additional layer of protection to their customers. Before either kind of transfer can be finalized, a series of steps must first be taken to verify the sender’s identity or the recipient’s banking information. Despite these precautions, however, mistakes and fraudulent activity can still take place. Canceling a wire transfer is typically a race against the clock because it is processed much more quickly than ACH transfers and is considered complete once the funds have been received. ACH transfers can be stopped.

- Transfer limits: Both ACH and wire transfers have daily transfer limits that must be adhered to. Confirm this with your financial institution, such as your bank or credit union.

- Processing times: The processing of an ACH transfer can take anywhere from one to several business days, whereas the majority of wire transfers are completed within one business day.

- Posting times: The recipient of a wire transfer can access the funds as soon as they are deposited into their account. ACH transfers are carried out in a slightly different manner: the funds will be shown as “pending” status and won’t be made available to you for use until the ACH system has been fully cleared. There is a possibility that this will take up to three business days.

- Reversals: If there was an error with your ACH transfer, the good news is that you might be able to reverse the transaction by submitting a request for it. Above all, wire transfers, on the other hand, do not provide this luxury and, once the transaction is started, it cannot be reversed.

- Fees: You should budget anywhere from $10 to $35 for the fee associated with each wire transfer that you start. There is a possibility that recipients will be required to pay a small fee for incoming wire transfers. The vast majority of ACH transfers are free, but there may be a fee associated with expedited bill pay services or transfers to banks located outside of the United States.

Difference between routing numbers, SWIFT/BIC codes, IBANs, and sort codes

If you want to send or receive money through your bank, you will most likely come across some terms that you are unfamiliar with, such as the SWIFT / BIC code, the IBAN, and the sort code. What do each of these acronyms stand for, and what do people typically refer to them as? However, each one is necessary for certain circumstances due to the fact that various countries and banks have varying procedures and requirements. Although they all appear to do essentially the same thing, which is to assist banks in determining where your money needs to go when it is being transferred, the reality is that they do not.

When processing domestic ACH payments or wire transfers in the United States, routing numbers, which are nine-digit codes, are used to identify individual banks. When making payments in countries other than the United States, you do not need to provide these.

SWIFT / BIC codes are unique identifiers that can be used by banks and other financial institutions all over the world. These codes can have either 8 or 11 digits. In contrast to routing numbers, these codes are utilized for financial transactions that take place on a global scale.

IBANs, or international bank account numbers, are a means by which a country, a financial institution, and individual bank accounts can be uniquely identified. The majority of banks in the Eurozone are the ones to issue them, but financial institutions in other regions are beginning to follow suit.

Sort Codes Sort Codes are 6-digit numbers that identify the bank and the branch where a bank account is held. These numbers are used for domestic transfers.

Note: This website provides a quick and easy way to search & find routing numbers for banks and other financial institutions in the United States. If you’re not sure which routing number to use contact your bank directly. You can call your bank using the phone number listed on your debit/credit card or send a message through your online banking system. Using the wrong routing number can lead to delays in processing the transfer.

About Our Codes

Based on our comprehensive database of more than 100,000 unique numbers/codes. This site is only available for informational purposes. Users need to know that while every effort is made to provide accurate information, this website does not guarantee that it is correct. The accuracy of the bank account information can only be verified by your bank. We advise getting in touch with your bank before making a time-sensitive, important payment.