Do you wish to invest in exchange-traded funds (ETFs), but you are unsure how to get started? After you have finished reading this article in its entirety, you will have the knowledge necessary to construct one or more ETF portfolios based on the topics that most interest you.

Content Recap:

The following exchange-traded fund portfolios will be constructed throughout this article:

- Technology & Blockchain ETF Portfolio

- Healthcare ETF Portfolio

- US Stocks & Bonds ETF Portfolio

- High Dividend & Income ETF Portfolio

- Electric & Self Driving Cars ETF Portfolio

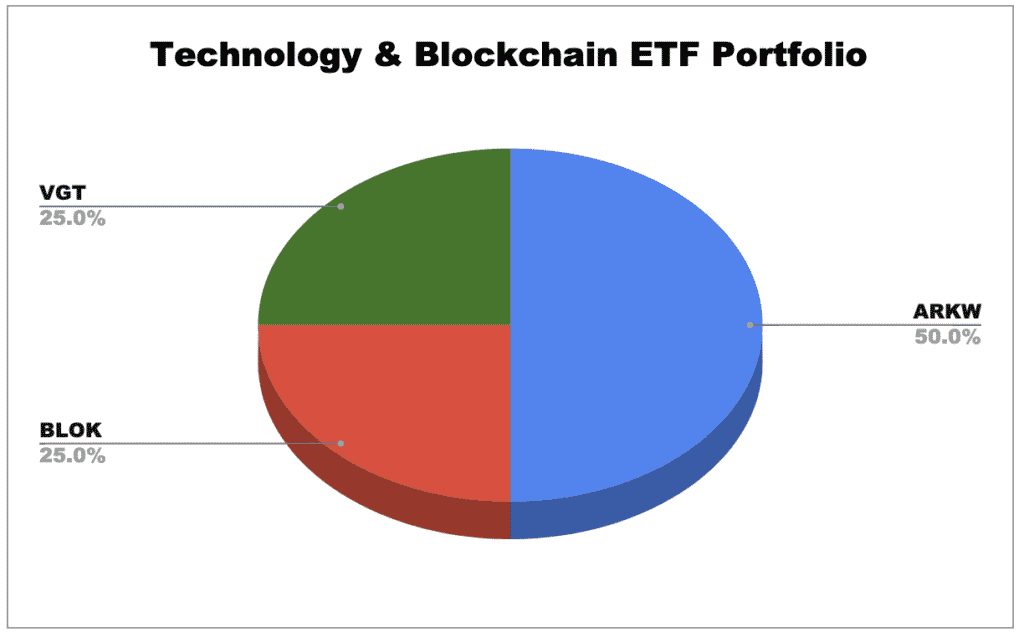

1. Technology & Blockchain ETF Portfolio:

If you want to invest in the technology sector as well as the blockchain technology, but you are unsure which stocks to buy or which companies are the best to invest in, you should think about copying this portfolio or building one that is comparable to it. If you do not know which stocks to buy or which companies are the best to invest in, you should copy this portfolio.

- Number of ETFs: 3 ETFs

- Risk Profile: High Risk

ARK Next Generation Internet ETF:

ARK Next Generation Internet ETF (ARKW) is an exchange-traded fund that invests in businesses that are developing the subsequent generation of the internet. The investment advisory firm run by Catherine Wood has an amazing track record of outperforming the market, which is something that the vast majority of stock pickers are unable to achieve.

- 5 Years Performance: 602%

- Popular Holdings: Tesla, Twitter, Zoom, Shopify

- ETF Symbol: ARKW – 50%

Transformational Data Sharing:

This exchange-traded fund (ETF) is one of only a few funds that make investments in companies that are active in blockchain technology. Blockchain is the technology that underpins cryptocurrencies like Bitcoin.

- 3 Years Performance: 162%

- Popular Holdings: Coinbase, Paypal, Microstrategy

- ETF Symbol: BLOK – 25%

Vanguard Information Technology

This exchange-traded fund follows the performance of a broad index of companies operating in the information technology industry, which the company classifies as consisting of three subsectors: hardware, consulting, and software.

- 5 Years Performance: 277%

- PopularHoldings: Apple, Microsoft, Google, Visa

- ETF Symbol: VGT – 25%

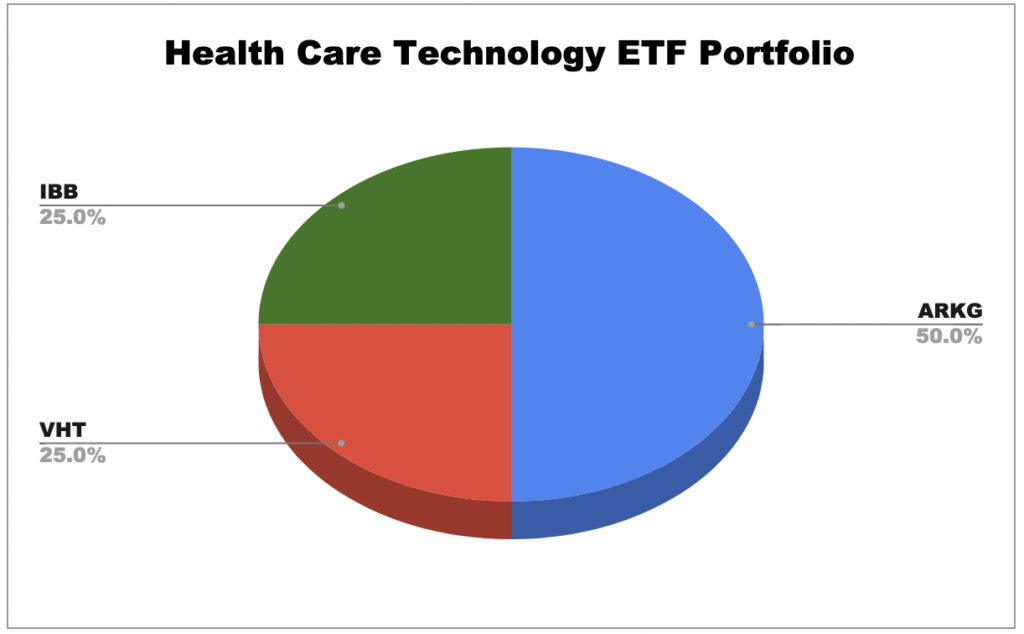

2. Healthcare Technology ETF Portfolio:

If you feel that advancements in medicine, pharmaceuticals, and medical equipment will lead to a prosperous future for the healthcare business, then you should seriously consider replicating this portfolio or constructing one that is very close to it.

- Number of ETFs: 3 ETFs

- Risk Profile: Moderate Risk

Genomic Revolution ETF

The Fund’s primary objective is to maximize its long-term return on capital. The Fund is an actively managed exchange-traded fund that will, under normal circumstances, invest primarily in domestic and foreign equity securities of companies operating in a variety of industries. These industries include healthcare, information technology, materials, energy, and consumer discretionary goods.

- 5 Years Performance: 400%

- Popular Holdings: Teladoc, Pacific Biosciences

- ETF Symbol: ARKG – 50%

Vanguard Healthcare ETF

The MSCI U.S. Investable Market Health Care Index is the particular benchmark index that the Fund will attempt to replicate in order to track the performance of a benchmark index that measures the investment return of health care equities. This is an index that tracks the stock prices of health care providers operating in the United States that fall into one of three categories: major, medium, or small.

- 5 Years Performance: 110%

- Popular Holdings: Pfizer, Moderna, J&J

- ETF Symbol: VHT – 25%

iShares Biotechnology ETF

The goal of the iShares Biotechnology ETF is to replicate the performance of an index that measures the value of biotechnology companies that are publicly traded in the United States.

- 5 Years Performance: 84%

- Popular Holdings: Moderna, Gilead, Illumina

- ETF Symbol: IBB – 25%

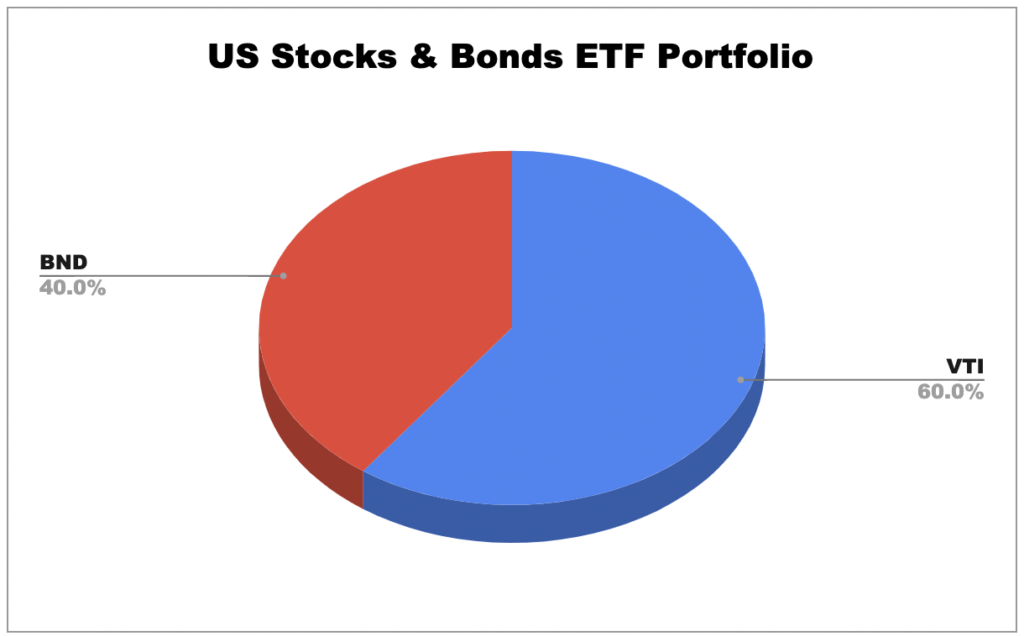

3. U.S Stocks & Bonds ETF Portfolio:

If you are seeking peace of mind and a portfolio in which you may continue to invest for the next 5,10,20, or even 25 years, then this straightforward portfolio is excellent. It holds US-based stocks and bonds.

- Number of ETFs: 2 ETFs

- Risk Profile: Depends on allocation. The higher you allocate on stocks, the higher the risk will be, while the higher you allocate on bonds, the safer this portfolio will be.

Vanguard total Stock Market

This exchange-traded fund provides broad exposure to the U.S. equity market by investing in thousands of securities across all market sectors. Investing in this ETF is equivalent to purchasing stocks from the entire US market.

- 5 Years Returns: 125%

- Popular Holdings: Microsoft, Apple, Tesla, JP Morgan, Visa

- ETF Symbol: VTI – 60%

Vanguard total Bond Market

This popular ETF provides exposure to the entire investment-grade bond market through a single ticker, holding Treasury bills, corporate bonds, mortgage-backed securities, and agency bonds. Although it owns securities with varying maturities, it is significantly weighted toward the shorter end of the curve.

- 5 Years Returns: 16%

- Popular Holdings: Mix of short and long term US Treasury and Corporation Bonds

- ETF Symbol: BND – 40%

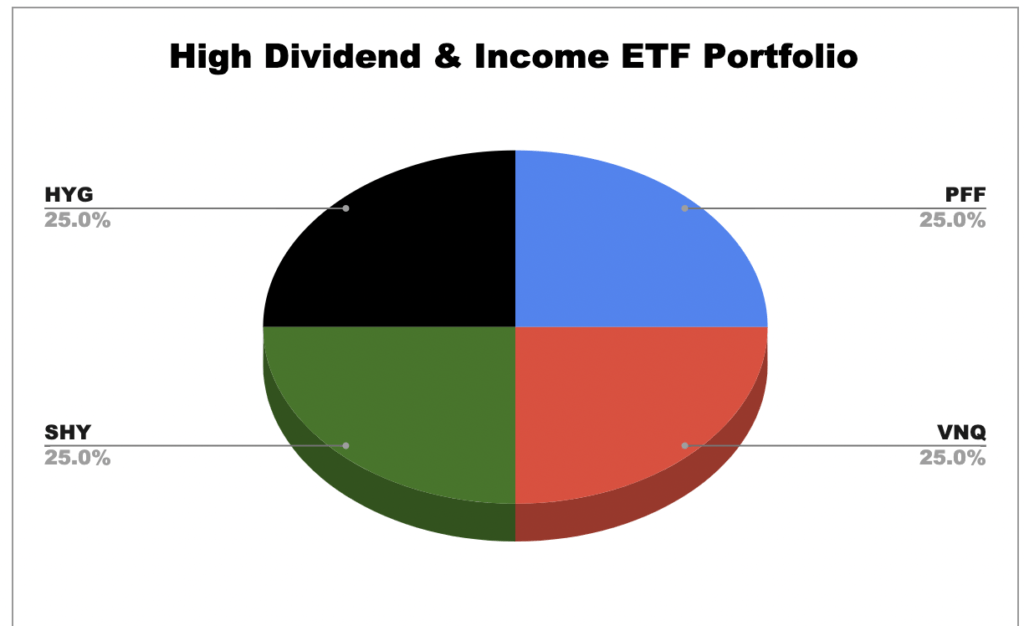

4. High Dividend & Income ETF Portfolio:

This ETF portfolio is ideal if you are a dividend investor seeking for a portfolio that can create income. It invests in dividend-generating assets with a high yield.

- Number of ETFs: 4 ETFs

- Risk Profile: Moderate

iShares Preferred & Income Securities ETF

This ETF provides exposure to favored equities for investors. Preferred stockholders are “preferred” above common stockholders and are the first to receive dividends upon the liquidation of the company’s assets.

- 5 Years Performance: 27%

- Popular Holdings: Bank of America, Citigroup

- ETF Symbol: PFF – 25%

Vanguard Real Estate

This ETF invests in equities issued by real estate investment trusts (REITs), which are companies that buy office buildings, hotels, and other real estate. It offers a high potential for investment income and some growth; share prices fluctuate more than those of bond funds.

- 5 Years Performance: 46%

- Popular Holdings: American Tower, Vanguard Real estate index funds

- ETF Symbol: VNQ – 25%

Ishares 1-3 Years Treasury Bonds

The objective of the iShares 1-3 Year Treasury Bond ETF is to replicate the performance of an index composed of U.S. Treasury bonds with remaining maturities between one and three years.

- 5 Years Performance: 8%

- Popular Holdings: Short Term Treasury Bonds

- ETF Symbol: SHY – 25%

Ishares High Yield Corporate Bonds

The iShares iBoxx $ High Yield Corporate Bond ETF aims to replicate the performance of an index comprising of high yield corporate bonds denominated in U.S. dollars.

- 5 Years Performance: 30%

- Popular Holdings: High Yield Corporate Bonds

- ETF Symbol: HYG – 25%

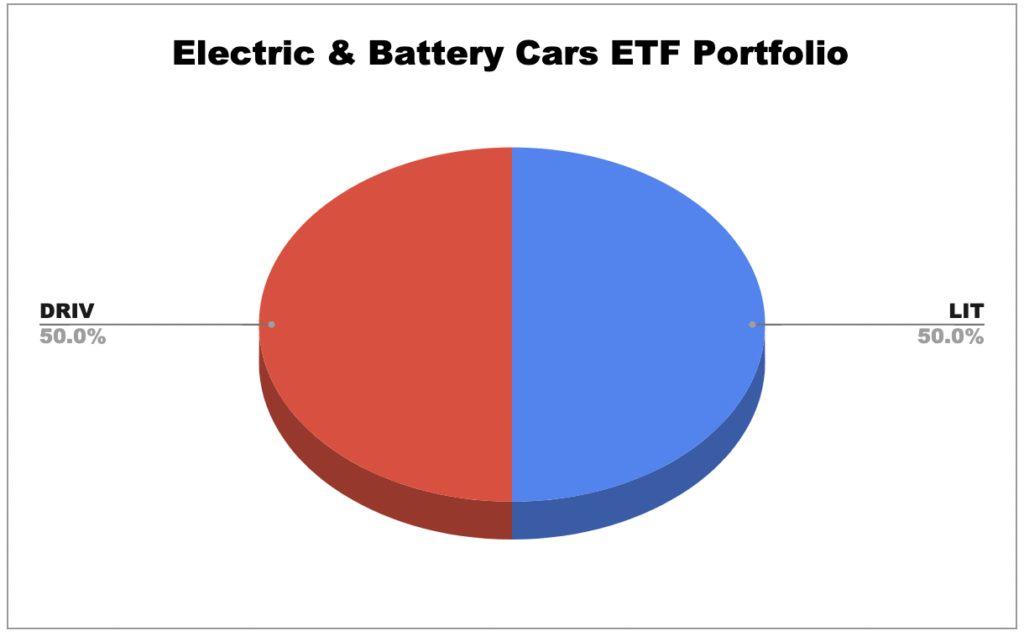

5. Electric & Battery Cars ETF Portfolio:

If you believe that the future of the electric car, battery car, and self-driving car industries will be bright, you can duplicate this ETF portfolio or create a similar one.

- Number of ETFs: 2 ETFs

- Risk Profile: High

Global X Lithium & Battery Tech ETF

The Global X Lithium & Battery Tech ETF (LIT) invests in the whole lithium value chain, from mining and processing the metal to battery manufacturing.

- 5 Years Performance: 274%

- Popular Holdings: Tesla, Samsung

- ETF Symbol: LIT – 50%

Global X Autonomous & Electric Vehicles ETF

The Global X Autonomous & Electric Automobiles ETF (DRIV) aims to invest in firms developing autonomous vehicle technology, electric vehicles (“EVs”), and EV components and materials. This includes firms developing autonomous vehicle software and hardware, as well as companies producing EVs, EV components such as lithium batteries, and crucial EV materials such as lithium and cobalt.

- 3 Years Performance: 100%

- Popular Holdings: Toyota, Tesla, Google

- ETF Symbol: DRIV – 50%

How to Invest in ETFs in UAE?:

If you like to invest in ETFs from the UAE, you can do it through brokers or with the assistance of a financial advisor, with whom you can discuss the investment plan and theme.

1. Invest in ETFs by your own:

To purchase ETFs on your own in the UAE, you must have an account with a brokerage firm that is registered with the exchange where you wish to trade ETFs.

One of the most famous brokers to invest in stocks and ETFs in Dubai are:

- Saxo Bank requires a minimum investment of $10,000

- Interactive Brokers one of the most commonly used brokers to invest in stocks & ETFs

- eToro our recommendation. Zero commission on buying stocks & ETFs, and no initial minimum investment

2. Invest in ETF through a Financial Advisor

A financial advisor can assist you if you don’t know how to do it yourself or don’t have the time to research and watch the news and markets. Their responsibility is to remain current on market trends and new possibilities. You will describe your objectives and risk tolerance, after which they will construct an ETF portfolio for you and do monthly reviews with you.

You can do your own research to find the best financial advisor in UAE. We chose this list carefully based on popularity, good reviews, the strength of the companies they work for, and the range of products and solutions they provide.